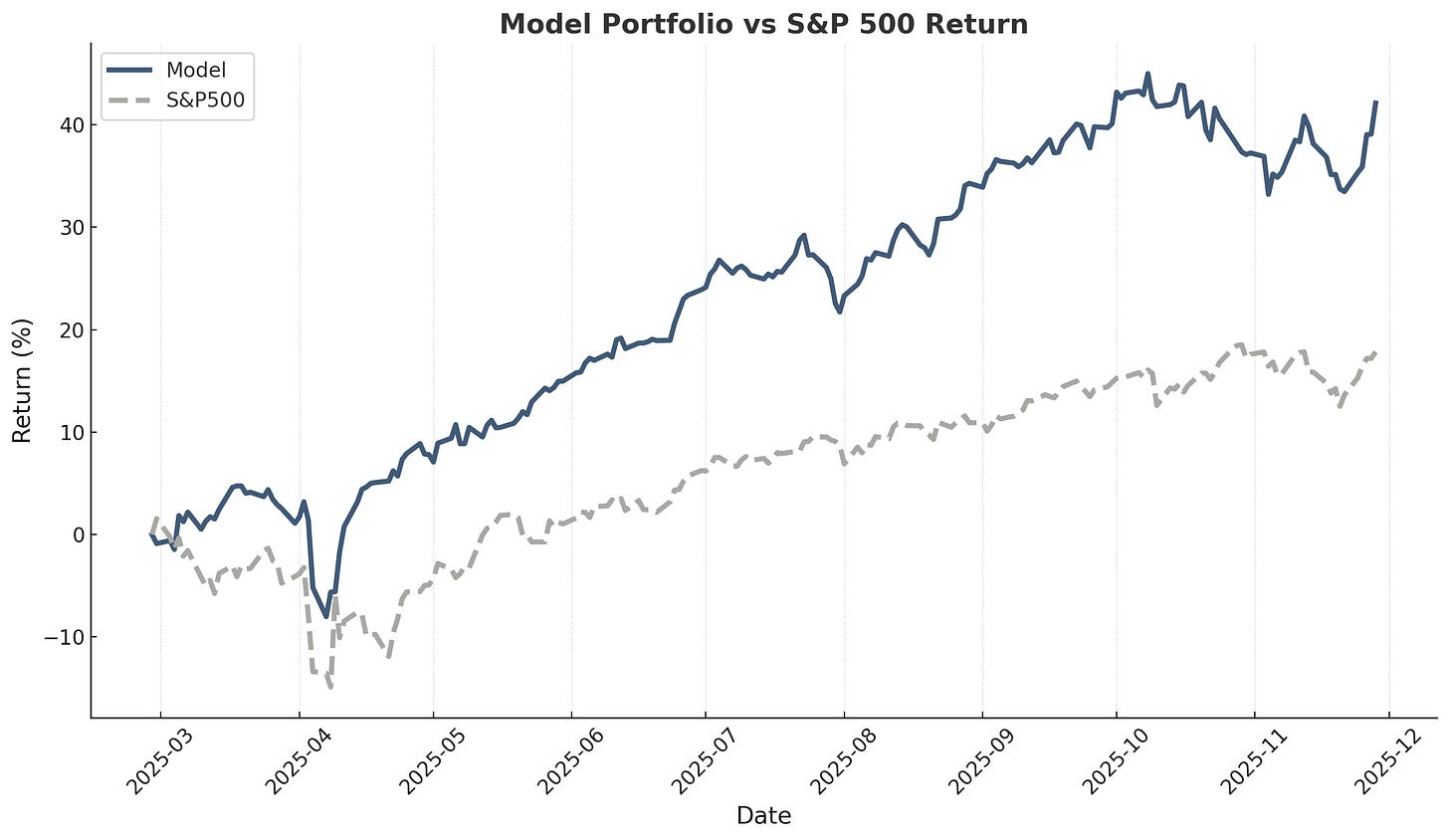

The model portfolio delivered +3.5% in November and +42.1% since inception 9 months ago, outperforming the S&P 500 by 24.3 percentage points over that period and beating the index in 7 of 9 months. After October’s challenging performance, the portfolio bounced back strongly, generating meaningful alpha in a month where the S&P 500 was essentially flat.

The deep-dive stocks continue to deliver exceptional results. The average return across all seven positions stands at +98%, with the four positions added before November average +166%. Three of those four are now multibaggers.

Markets in November

November saw a tale of two markets. The S&P 500 finished essentially flat at +0.2%, consolidating after October’s gains as the market digested mixed economic signals. The longest U.S. government shutdown in history came to an end mid-month, initially providing a lift to risk assets before stronger-than-expected jobs data dampened expectations for further Fed rate cuts. By the end of the month, that sentiment has again reversed and a Fed rate cut is now likely.

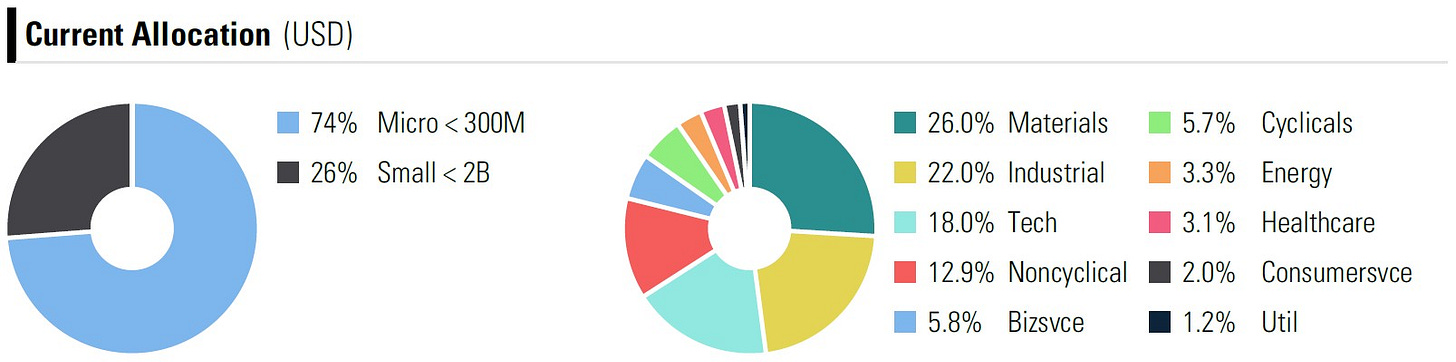

Small caps and micro caps continued their challenging year, though valuations remain deeply discounted. On both an absolute value and relative value basis, small-cap stocks remain very attractive, trading at a 16% discount to fair value estimates. This persistent undervaluation creates ongoing opportunity for systematic approaches.

Precious metals experienced significant volatility. Gold reached $4,242.50 on November 13 before falling back below $4,100 the next day and back above $4,200 by the end of the month. Despite the consolidation in the gold price, gold miners as a sector surged 120% year-to-date but remain undervalued, with strong margins and improved capital discipline. This environment has been favorable for the model portfolio this year as both value and momentum metrics put many small-cap precious metal producers at the top of the ranking. For insights on how the model captures such outperformers, check the recent study: Live Case Study - Ranking Silver & Gold Miners.

Model Portfolio Performance

Key Performance Metrics:

Return results (as of Nov 30):

Total return (9 months): 42.1%

S&P 500 return (same period): 17.8%

Alpha generated: 24.3%

Monthly beats: 7 of 9 (78%)

Realized trades (as of Nov 30):

Win rate: 55% of 67 trades

Average return: 12.4%

Average days held: 111.5 days

Portfolio turnover: 130% (first 9 months or 173% annualized)

Risk-adjusted metrics (since inception):

Beta: 0.29

Sharpe Ratio: 2.99 (vs. 1.45 for S&P 500)

Sortino Ratio: 3.97 (vs. 1.79 for S&P 500)

Maximum Drawdown: -12.2% (vs. -16.2% for S&P 500)

Model Portfolio Holdings

As of November 30th, the portfolio's largest position (8.9%) is gold and silver miner APM, a deep-dive stock that is currently up 530% since entry. The portfolio now holds four multibaggers: three gold miners and a European industrial stock. Two deep-dive stocks are (former) portfolio positions and up 139% and 94% (realized). The portfolio currently has 3 realized multibagger trades (a consumer, industrial and technology stock) and 4 others realized trades with +88% returns.

Deep-Dive Stock Performance

My deep-dive stocks are an additional service for my paid subscribers. I do a much deeper quantitative and qualitative analysis for a selection of top-ranked stocks. I try to come up with a new ideas every 1-2 months, but it is always subject to finding good ideas that have the potential to outperform the model portfolio (which sets a very high bar). All deep-dive stocks have a bear, base, and bull case target and estimated probability. They are reviewed after one year and held on the list for another year if the potential upside is still there. I notify personal trades in deep-dive stocks in our paid subscribers chat and in this monthly update.

The deep-dive average return stands at +98% across all seven positions. Excluding the new November additions (which have had less than two weeks to perform), the original four positions average +166% return. Three of those four are multibaggers (current returns: +424%, +139%, and +102%). The fourth, Thunderbird Entertainment, will be acquired by Blue Ant Media. I published a deep-dive evaluating the options for shareholders: Analyzing the Blue Ant “Take-Under” of Thunderbird.