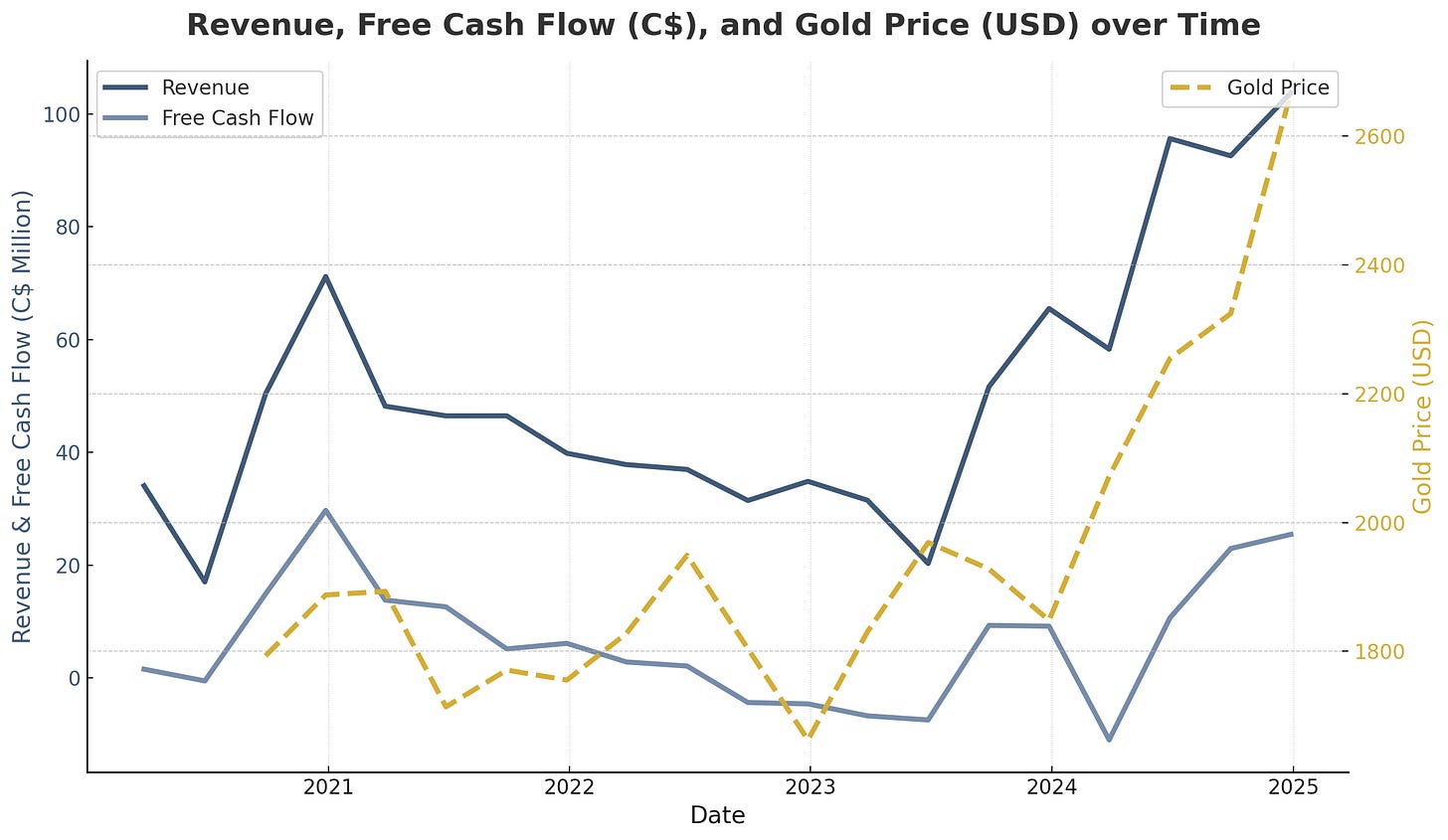

In today's precious metals bull market, I've identified an extraordinary opportunity flying completely under Wall Street's radar. This dual-asset producer is generating substantial free cash flow with a remarkable 22% FCF yield while trading at just 2.3x forward EBITDA – a 74% discount to peers. With an asymmetric risk-reward profile offering 324% upside in the bull case and an estimated 42% probability of delivering multibagger returns within 2 years, this hidden gem is positioned perfectly to capitalize on rising gold and silver prices. The company maintains a fortress balance sheet with significant net cash, providing both downside protection and optionality for value-creating growth initiatives. The stock was a portfolio model stock pick on Feb 28th and had a top rank in the 98th percentile of all ranked stocks.

Deep-Dive Analysis: Andean Precious Metals

Company Overview

Andean Precious Metals (APM:CAN) is a growing precious metals producer with operations in Bolivia and the United States. The company owns and operates the San Bartolomé processing facility in Potosí, Bolivia, which is the country's only silver oxide mill, and the Golden Queen mine in Kern County, California. This dual-asset approach provides diversification both geographically and across precious metals, with exposure to both silver (through San Bartolomé) and gold (through Golden Queen).

The company acquired Golden Queen in 2023, transforming from a single-asset silver producer into a multi-asset precious metals company. This strategic acquisition has already proven successful, with Golden Queen contributing significantly to production and cash flow in its first full year of operation under Andean's management. The company has demonstrated strong operational execution, with San Bartolomé consistently improving margins and Golden Queen ramping up production effectively throughout 2024.

Andean Precious Metals stands out for its exceptionally strong balance sheet, with US$101 million in liquid assets (including US$62.4 million in cash and US$38.6 million in marketable securities) against US$70.3 million in debt as of December 31, 2024. This financial strength provides significant optionality for future growth, whether through organic expansion, additional acquisitions, or returning capital to shareholders.

Quantitative Assessment

The following analysis is based on a review of Andean Precious Metals' financial data, including the company's Q4 and full-year 2024 financial results, Gurufocus financial data (March 26, 2025), and equity research reports from SCP Resource Finance and Atrium Research (both dated March 19, 2025).

Ranking Position:

Current Alpha Engineer Rank: 94

Rank when added to Model Portfolio on February 28, 2025: 98

The stock maintains its position in the top decile of my quantitative model

Key Metrics:

Company value

Current Price: C$1.65 (as of March 25, 2025)

Market Capitalization: C$246.2 million (US$172 million)

Enterprise Value: US$141 million

Net Cash Position: US$31 million

Operational results (US$) and current valuation

Historical results

Company results (Golden queen acquired in Nov 2023)

San Bartolomé

Golden Queen

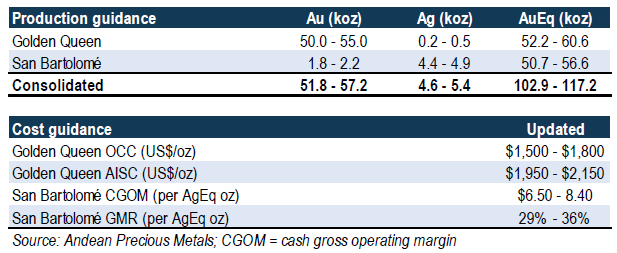

Company guidance

Production and cost guidance:

Capex of both mines including exploration budget is estimated at ~$30M

Analysis

Examining Andean's operational performance reveals a company undergoing significant transformation. The acquisition of Golden Queen for C$65 million in 2023 has dramatically altered the company's production profile, with the US-based asset now producing slightly more than half of the company's equivalent gold output. This strategic move has not only diversified Andean's geographical exposure but also substantially increased its revenue base.

San Bartolomé, the company's original asset, has seen its mine life extended to 2028 and experienced impressive margin improvements throughout 2024, largely driven by higher silver prices and operational efficiencies. The cash gross operating margin (CGOM) reached US$11.09/oz in Q4, compared to a full-year CGOM of US$9.15/oz, reflecting both favorable market conditions and management's focus on cost optimization.

While San Bartolomé provides a stable production base, US-based Golden Queen represents the company's primary growth engine. With an all-in sustaining cost of approximately US$2,000/oz gold, the operation generates significant cash flow at current gold prices. More importantly, Golden Queen offers substantial exploration upside that could extend mine life and increase production volumes. Management has indicated exploration for mine life extension is a key focus, with additional details expected following Q1 2025 results.

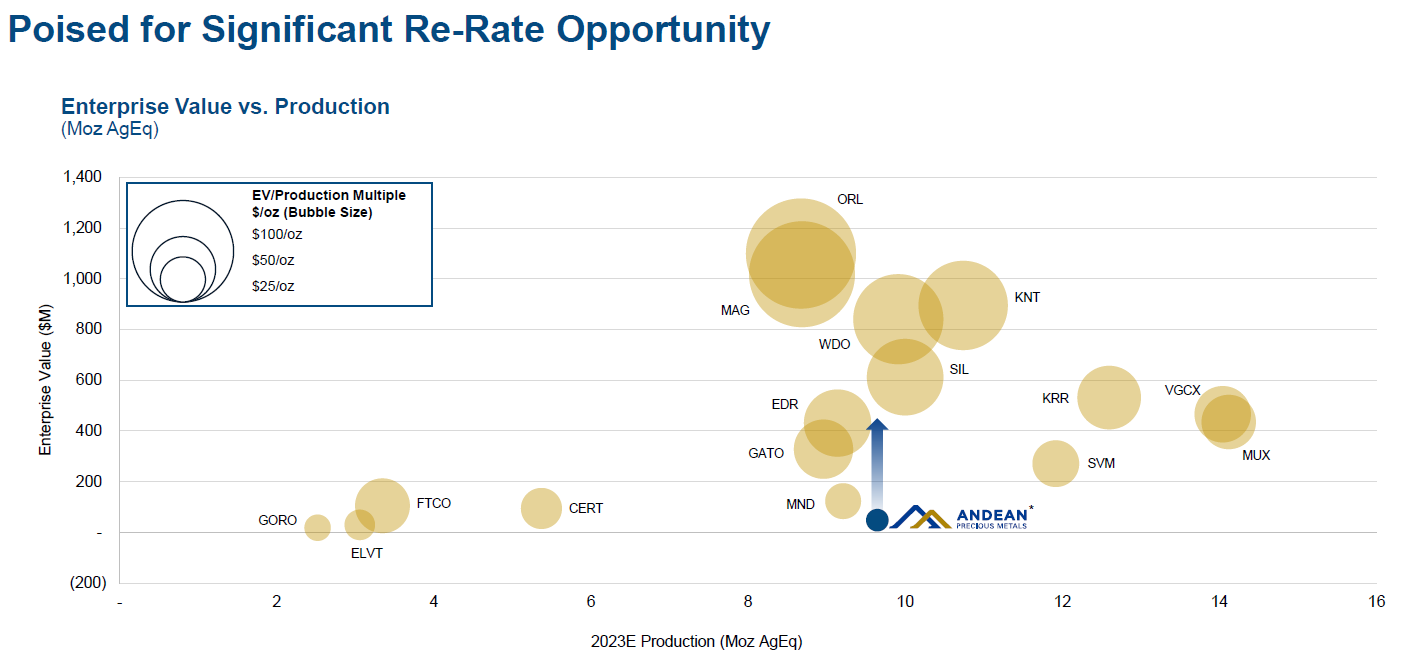

Trading at just 2.3x 2025E EBITDA compared to ore processors at 6.6x and small/mid-cap producers at 9.0x, Andean's valuation disconnect is striking. This 65-74% discount to peers persists despite the company's superior free cash flow generation (22% FCF yield) and stronger balance sheet. The company's temporarily muted Q4 performance versus guidance, explained in the Atrium report as "mainly attributed to a temporary suspension of crushing and stacking activities in September 2024 which impacted production in Q4/24," appears to have prevented share price appreciation in line with sector trends. This operational hiccup, which was not properly reflected in company guidance, has created an attractive entry point before the market fully recognizes Andean's improved cash flow generation capabilities.

Qualitative Evaluation

The following SWOT analysis is based on company materials, the equity research reports cited earlier, and AI-assisted deep-dives. I should note that I am not a precious metals sector expert, and this analysis does not claim to capture every detail or nuance of the company's operations. Rather, I've attempted to identify the main points that appear most relevant to the investment thesis. Readers are encouraged to conduct their own additional due diligence. For my investment approach, what matters most is developing reasonable assessments of the bear, base, and bull scenarios.

Strengths:

Dual-asset portfolio provides operational diversification

Exceptionally strong balance sheet with significant net cash position

San Bartolomé is Bolivia's only silver oxide mill, creating a competitive moat

Proven management execution in improving margins at San Bartolomé

Successful integration of Golden Queen acquisition

Substantial free cash flow generation

High insider ownership (CEO owns 53% of shares, Eric Sprott owns 15%)

Strong leverage to rising precious metals prices (1.3x beta to silver, 2.4x beta to gold)

Weaknesses:

Political risk in Bolivia (though mitigated by presence in the US)

Limited operating history of Golden Queen under Andean's management

Relatively short mine lives without successful exploration

Capital allocation strategy still evolving

Limited analyst coverage and market awareness

History of missing guidance, as explained in the Atrium Research report (attributed to a temporary suspension of crushing and stacking activities in September 2024 which impacted production in Q4/24). For context, check the video of Thedeepdive.ca in the references.

Opportunities:

Exploration potential at Golden Queen to extend mine life

Acquisition opportunities given strong balance sheet and M&A expertise

Potential for multiple expansion as consistent operational performance continues

Ability to capitalize on rising precious metals prices

Implementation of shareholder return program (dividends/buybacks)

Threats:

Potential decline in precious metals prices

Political risks in Bolivia could impact San Bartolomé

Operational challenges at either mine

Reduced production as current resources are depleted

Rising costs due to inflation or lower head grades

Unsuccessful exploration programs

Scenario Development

Drawing from my analysis, the research reports and macroeconomic analysis, I've developed three distinct scenarios for Andean Precious Metals over a two-year investment horizon. These scenarios account for varying precious metals price environments, operational execution, and market sentiment toward the company. The bear case assumes an unfavorable dip in precious metals prices, the base case aligns with the consensus views presented in equity research reports, while the bull case models a favorable precious metals environment (supported by current macro tailwinds) combined with successful execution and a re-rating opportunity projected by management and the Atrium research report.

Bear Case (20% Probability):

Price Target: C$1.30 (21% downside from current price)

Gold Price Assumption: $2000/oz to $2,500/oz

Silver Price Assumption: $25/oz to $30/oz

Key Assumptions:

Golden Queen encounters operational difficulties (no growth)

Metal prices decline significantly from current levels (~2024 average)

Exploration fails to extend mine life significantly at Golden Queen

Multiple remains depressed at ~2.0 EV/EBITDA

Financial Implications:

2025-2026 FCF generation below guidance

No progress on M&A despite strong balance sheet

Multiple compression due to operational challenges

Base Case (50% Probability):

Price Target: C$3.00 (82% upside from current price)

Gold Price Assumption: ~$2,500/oz

Silver Price Assumption: ~$30/oz

Key Assumptions:

Metal prices similar to H2 2024 average

Production in line with 2025 guidance and 2026 expectations

Modest exploration success at Golden Queen

EBITDA growth and modest multiple expansion

Price target = average of Atrium and SCP 2025 price target

Financial Implications:

Strong FCF generation continuing through 2025-2026

Reduction of debt or initiation of shareholder returns

Minor multiple expansion to 3-3.5 EV/EBITDA

Bull Case (30% Probability):

Price Target: C$7.00 (324% upside from current price)

Gold Price Assumption: $3000/oz to $3,500/oz

Silver Price Assumption: ~$35/oz

Key Assumptions:

Macro tailwinds with continuing bull run of metal prices

Production in line with 2025 guidance and 2026 expectations

EBITDA ~2x 2024 (impact of precious metal prices)

Significant exploration success at Golden Queen as the company will put more effort in due to higher prices (as mentioned in their latest call)

Additional strong points such as implementation of dividend policy or M&A activities

Multiple expansion to 5.0x EV/EBITDA as company start to re-rate to peer valuations

Financial Implications:

Exceptional FCF generation (supported by execution and metal prices)

Substantial extension of Golden Queen mine life

Strategic M&A enhancing growth profile

Initiation of dividend providing additional shareholder returns

Expected Return:

Probability-weighted price target: C$1.30 (20%) + C$3.00 (50%) + C$7.00 (30%) = C$3.86

Implied upside from current price of C$1.65: 134%

Annualized expected return over 2-year horizon: 53%

Multibagger Probability: 42% chance of achieving multibagger status (100%+ return) within 2 years

Primary contribution from Bull Case (30% probability)

Additional contribution from scenarios between Base and Bull Cases where the price exceeds C$3.30

Catalysts and Timeline

Several potential catalysts could drive Andean's share price higher over the next 12-24 months:

Quarterly Operational Results (Ongoing): Continued demonstration of strong operational execution and cash flow generation should gradually build market confidence. Particularly important will be Q1 2025 results expected in May, which will provide insights into the company's progress against 2025 guidance.

Exploration Results (2025): The company is focused on exploration at Golden Queen to extend the mine life. First results are expected following Q1 2025, with ongoing updates throughout the year. Positive results could significantly enhance the asset's value.

Strategic Deployment of Cash (2025-2026): With over US$100 million in liquid assets, Andean has several options to enhance shareholder value, including:

Debt reduction/refinancing (expected in Q4 2025)

Share repurchase program

Dividend initiation

Strategic acquisitions

Multiple Expansion (Ongoing): As Andean establishes a longer track record of consistent operational performance, particularly at Golden Queen, the valuation discount to peers should narrow, driving share price appreciation independent of operational improvements.

Precious Metals Price Appreciation (Ongoing): With high beta to both gold and silver prices, continued strength in precious metals would significantly benefit Andean's financial results and share price performance.

Additionally, it is also important to note that CEO Alberto Morales brings over 30 years of M&A and finance experience, with significant skin in the game through his 53% ownership and that Canadian businessman and investor Eric Sprott has a 15% position. He is renowned for his expertise in precious metals and natural resource investing. A contrarian by nature, Sprott is known for investing heavily in junior mining companies—small, often speculative ventures that he believes have significant growth potential.

Conclusion

Andean Precious Metals is a cash-flowing business with strong fundamentals trading at a significant discount to intrinsic value. With its dual-asset portfolio, robust balance sheet, and exceptional free cash flow generation, the company offers substantial upside potential while maintaining limited downside risk. The asymmetric risk-reward profile (21% downside risk vs. 134% expected return) makes it an exceptionally attractive opportunity in the current market environment.

References

This analysis draws upon the following sources:

SCP Resource Finance Research Report on Andean Precious Metals (March 19, 2025) - https://www.scp-rf.com/

Atrium Research Report on Andean Precious Metals (March 19, 2025) - https://www.atriumresearch.ca/

Andean Precious Metals Q4 and Full Year 2024 Financial Results (March 18, 2025) - https://www.andeanpm.com/investors/news-releases/

Gurufocus Financial Data (March 26, 2025) - https://www.gurufocus.com/stock/TSX:APM/

AI deep research using Grok 3 DeepSearch, ChatGPT 4.5 Deep Research and Claude Sonnet 3.7 Extended.

The Alpha Engineer Ranking (March 25, 2025) - https://www.thealphaengineer.com/

World Gold Council: Gold Market Statistics - https://www.gold.org/goldhub/data/gold-prices

The Silver Institute: Market Statistics - https://www.silverinstitute.org/silver-price/

San Bartolomé Production Data - https://www.andeanpm.com/operations/san-bartolome/

Golden Queen Production Data - https://www.andeanpm.com/operations/soledad-mountain/

Andean Precious Metals Investor Presentations - https://www.andeanpm.com/investors/presentations/

Thedeepdive.ca: "Andean Precious Metals Q4 Earnings: A Guidance Failure" - https://thedeepdive.ca/andean-precious-metals-q4-earnings-a-guidance-failure/

Andean Precious Metals Corp. presentation from the February 12th-13th Metals & Mining Virtual Investor Conference -

Learn more about my investing framework:

Read about my overall portfolio strategy.

See the full details of my systematic method for stock picking.

The Alpha Engineer --- Investing with a quantitative edge

Disclaimer: The Alpha Engineer shares insights from sources I believe are reliable, but I can't guarantee their accuracy---data's only as good as its inputs! This content (whether on Substack, via email newsletters, X, or elsewhere) is for informational and educational purposes only---it's not personalized investment advice. I'm not a registered investment advisor, just an engineer crunching numbers for alpha. My opinions are my own and may shift without notice. Investing involves risks, including the chance of losing money. Past performance, whether from back-testing or historical data, does not guarantee future results---outcomes can vary. So, please consult your financial advisor to see if any strategy fits your situation. Full disclosure: I may own positions in the securities I mention, as I actively manage my own portfolio based on these strategies.