Hidden Gold: Two Miners Trading at <5x P/E With Triple-Digit Upside

The Alpha Engineer Deep-dive

My quantitative model has identified two exceptional gold miners hiding in inefficient market corners. Both trade at P/E ratios below 5x with EV/EBITDA ratios under 3.5x. They're generating substantial free cash flow with margins expanding rapidly at current gold prices. One offers a 6% forward dividend yield while both have double-digit analyst target upsides. More compelling: my analysis calculates probability-weighted returns of 83% and 152% over the next two years and returns of +200% and +300% in a bull case scenario. These aren't explorers hoping to find gold—they're established producers with clear growth catalysts and significant expansion potential. What the market may have missed: both have mine life extensions exceeding 10 years and operating leverage that dramatically amplifies profitability as gold prices rise.

The Gold Mining Sweet Spot

The current market presents optimal conditions for select gold miners. Gold prices remain near record levels while oil costs are relatively contained. This creates exceptional margins for efficient producers. My quantitative model analyzes global stocks across various exchanges, identifying those with the optimal combination of value, quality, and momentum. Many miners currently rank highly in my system. My analysis identified ten miners ranking 90+ in my model. Two in particular (plus Andean Precious Metals, covered previously) display the metrics that signal exceptional return potential with reasonable downside risk. The key differentiator: these companies operate in specific market segments where their estimated production growth (30-100% over two years) isn't yet reflected in share prices.

While all gold miners face geopolitical and operational risks, exposure to these three specific companies—rather than concentration in just one—may provide a more favorable risk-adjusted return. In general, a basket of top-ranked gold miners is likely to significantly outperform the market when the gold price remains favorable in the coming years due to the macro tailwinds. However, focusing on miners that have not yet re-rated to higher multiples helps manage expectations and limits downside risk in a scenario where gold prices decline.

Systematic Selection Process

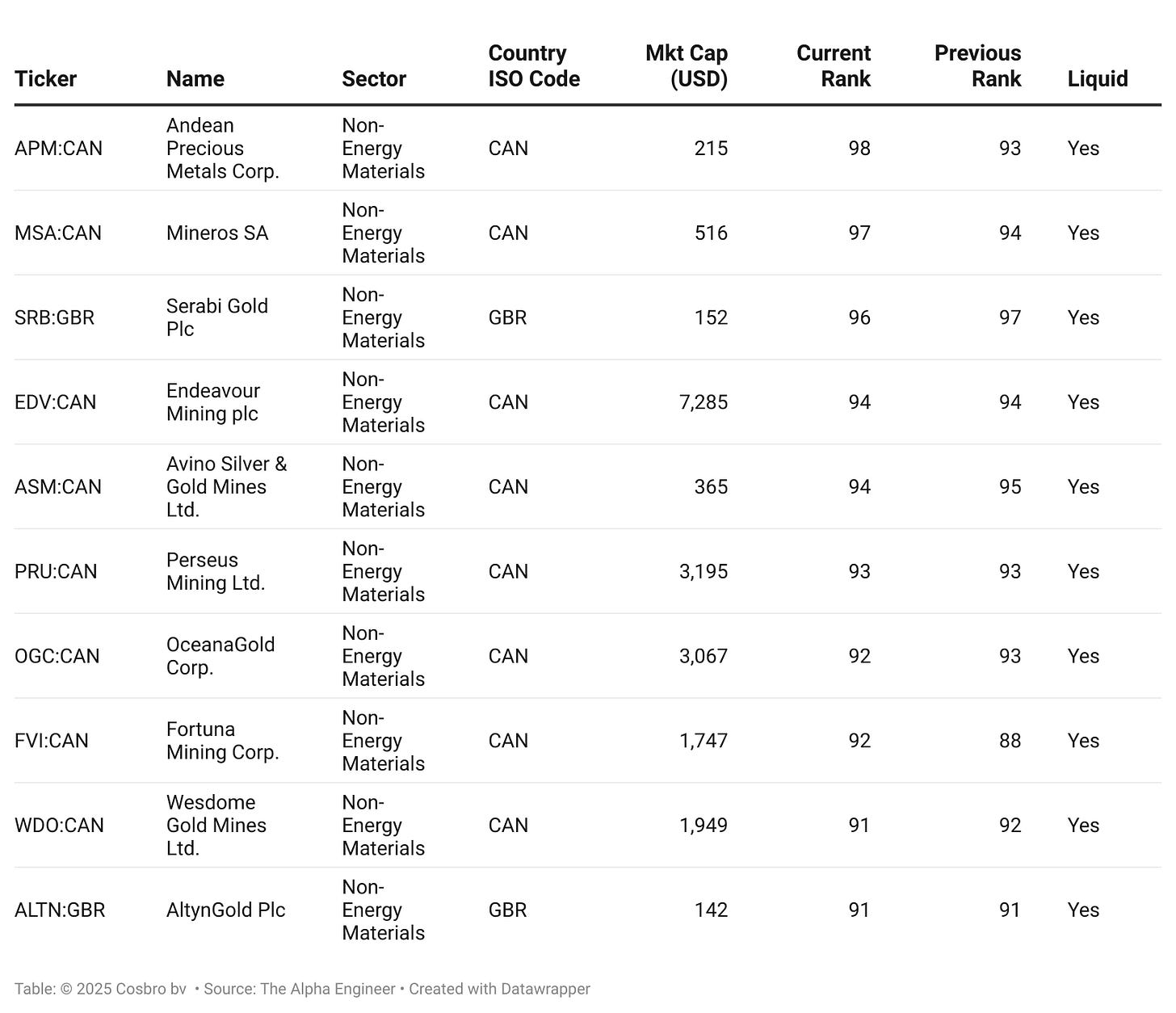

The table below shows the gold miners with a ranking of 90 or higher on The Alpha Engineer model as of May 11th, 2025:

Here's a summary of the 10 top-ranked precious metal stocks:

Ticker: APM:CAN

Company Name: Andean Precious Metals Corp.

Summary: Andean Precious Metals Corp. (APM:CAN) is focused on precious metals production and exploration with its San Bartolomé silver mine in Bolivia and the Golden Queen mine in the USA. See deep-dive for details.

Ticker: MSA:CAN

Company Name: Mineros SA

Summary: Mineros SA (MSA:CAN) is a gold producer with alluvial mining in Colombia (Nechí) and underground/artisanal operations in Nicaragua (Hemco). It has a low P/E of 4.8, a dividend yield of 5.9%, and analyst target upside of 25.0%. Potential risks include exposure to geopolitical risks in its operating regions.

Ticker: SRB:GBR

Company Name: Serabi Gold Plc

Summary: Serabi Gold Plc (SRB:GBR) is a gold mining company focused on Brazil, operating the Palito Complex and developing the Coringa project in the Tapajós region. It has a sales growth at 18.0% and analyst target upside of 35.0%. Potential risks include exposure to geopolitical risks in its operating regions.

Ticker: EDV:CAN

Company Name: Endeavour Mining plc

Summary: Endeavour Mining plc (EDV:CAN) is a major gold producer with multiple mines across West Africa, including in Senegal, Cote d'Ivoire, and Burkina Faso. It has a EV/EBITDA of 6.5, a dividend yield of 3.0%, and sales growth at 16.0%. Potential risks include exposure to geopolitical risks in its operating regions.

Ticker: ASM:CAN

Company Name: Avino Silver & Gold Mines Ltd.

Summary: Avino Silver & Gold Mines Ltd. (ASM:CAN) primarily produces silver, gold, and copper from its Avino Mine property near Durango, Mexico. It has a sales growth at 22.0% and analyst target upside of 28.0%. Potential risks include a P/E of 28.5, and reliance on its Mexican operations.

Ticker: PRU:CAN

Company Name: Perseus Mining Ltd.

Summary: Perseus Mining Ltd. (PRU:CAN) operates gold mines in West Africa, such as Edikan (Ghana) and Sissingué/Yaouré (Côte d'Ivoire), and is developing the Meyas Sand project in Sudan. It has a P/E of 7.5, a dividend yield of 3.5%, and analyst target upside of 22.0%. Potential risks include exposure to geopolitical risks in its operating regions.

Ticker: OGC:CAN

Company Name: OceanaGold Corp.

Summary: OceanaGold Corp. (OGC:CAN) is a multinational gold producer with key assets including the Haile mine (USA), Didipio (Philippines), and Macraes/Waihi (New Zealand). It has an EV/EBITDA of 5.5, sales growth at 17.0%, and analyst target upside of 24.0%. Potential risks include a net debt/equity ratio of 0.5.

Ticker: FVI:CAN

Company Name: Fortuna Silver Mines Inc.

Summary: Fortuna Silver Mines Inc. (FVI:CAN) is a precious and base metals producer with mines in West Africa, Mexico, Peru, and Argentina. It has sales growth at 25.0% and analyst target upside of 30.0%, operating with a P/E of 15.5. Potential risks include a higher AISC of $1680/oz, a net debt/equity ratio of 0.4, and exposure to geopolitical risks in its operating regions.

Ticker: WDO:CAN

Company Name: Wesdome Gold Mines Ltd.

Summary: Wesdome Gold Mines Ltd. (WDO:CAN) is a Canadian gold producer focused on high-grade underground mining at its Eagle River and Kiena Complex operations in Ontario and Quebec. It has sales growth at 30.0% and a low net debt/equity ratio of 0.1. Potential risks include a higher P/E of 22.0.

Ticker: ALTN:GBR

Company Name: AltynGold Plc

Summary: AltynGold Plc (ALTN:GBR) is a gold mining company primarily operating the Sekisovskoye mine in Kazakhstan. It has a P/E of 3.5 and significant analyst target upside of 50.0%. Potential risks include its single asset concentration and exposure to geopolitical risks in its operating regions.

After conducting an in-depth review of all ten stocks, two stood out alongside APM. They happen to be the 2nd and 3rd highest-ranked stocks in my quantitative model (percentile ranks 97 and 96 respectively), which provides additional confidence in their potential.

Deep-Dive Analysis: Mineros SA

Company Analysis

Company Profile: Mineros SA (MSA:CAN) is a Latin American gold producer with over 50 years of operating history. It has a diversified asset base with operations in Colombia (Nechí Alluvial - dredge and artisanal), Nicaragua (Hemco - underground mine and significant artisanal miner supply) and has a 20% interest in La Pepa Project in Chile, a greenfield project. The company emphasizes its track record of profitability, experienced management, commitment to sustainability and social license, and a history of returning capital to shareholders through dividends.

Operations & Production (as of early 2025):

Nechí (Colombia): Alluvial operations primarily using dredges. Also sources from artisanal miners. 2025 production guidance: 81,000 - 91,000 oz.

Hemco (Nicaragua): Underground mining operations and a significant portion of ore purchased from artisanal miners under the "Bonanza Model". 2025 production guidance (including artisanal): 120,000 - 132,000 oz.

Consolidated 2025 Guidance: 201,000 - 223,000 ounces of gold.

Financial Highlights & Costs:

Q1 2025 Results: Produced 54,243 oz gold. Average realized gold price $2,881/oz. AISC $1,685/oz. Record revenue $160.6M, record net profit $38.0M (EPS $0.13 based on prior share count). Cash $81.26M, Debt $28.1M (Net Cash ~$53.2M).

2025 AISC Guidance: Consolidated $1,650 - $1,750/oz.

Nechí: AISC $1,440 - $1,540/oz.

Hemco & Artisanal: AISC $1,680 - $1,780/oz (note: artisanal ore purchase costs are linked to gold price, creating variability).

Dividends: Historically a strong dividend payer. CSV data shows 5.85% yield (CAD); company communications highlight an attractive yield.

Valuation (May 15, 2025):

Market Cap CAD 513.15M

P/E 4.76x

EV/EBITDA 1.96x

Price/FCF 6.68x.

Summary of Mine Lives and Exploration for Extension:

Nechí Alluvial Property: Has a Life of Mine (LOM) based on reserves extending approximately 12 years (from 2025 to 2036). A 10,000-meter drill program was planned for 2025 focused on resource expansion, reserve conversion, and infill drilling to further extend this.

Hemco Property (Nicaragua): The development of the Porvenir Project is central to extending Hemco's operational life. Porvenir is expected to commence operations around 2027, adding ~44,000 oz gold annually and contributing to an overall Hemco complex mine life of approximately 13 years. Other deposits (Leticia, San Antonio) and targets on the property also offer further exploration potential.

Strategy & Growth:

Focus on operational excellence and cost management.

Maintain strong relationships with artisanal miners.

Growth through optimizing existing assets and disciplined M&A. Targeting assets producing 70k-130k oz annually to potentially increase group output to 350k-500k oz.

Advancement of the Porvenir Project in Nicaragua.

Key Strengths:

Diversified asset base across two countries.

Long operating history and experienced management.

Strong cash flow generation and profitability, especially at higher gold prices.

Significant leverage to gold price through own production and artisanal supply structure.

Commitment to shareholder returns via dividends.

Relatively strong balance sheet with net cash.

Key Risks:

Jurisdictional Risk: Operates in Colombia and Nicaragua, which can present political, social, and security challenges.

Artisanal Miner Dependence: A significant portion of Hemco's production relies on ore from artisanal miners, introducing variability in supply and costs.

Operational Challenges: Alluvial operations (Nechí) can face issues like dredge availability.

Cost Inflation: Standard mining industry risks.

M&A Execution: Risks associated with identifying, acquiring, and integrating new assets.

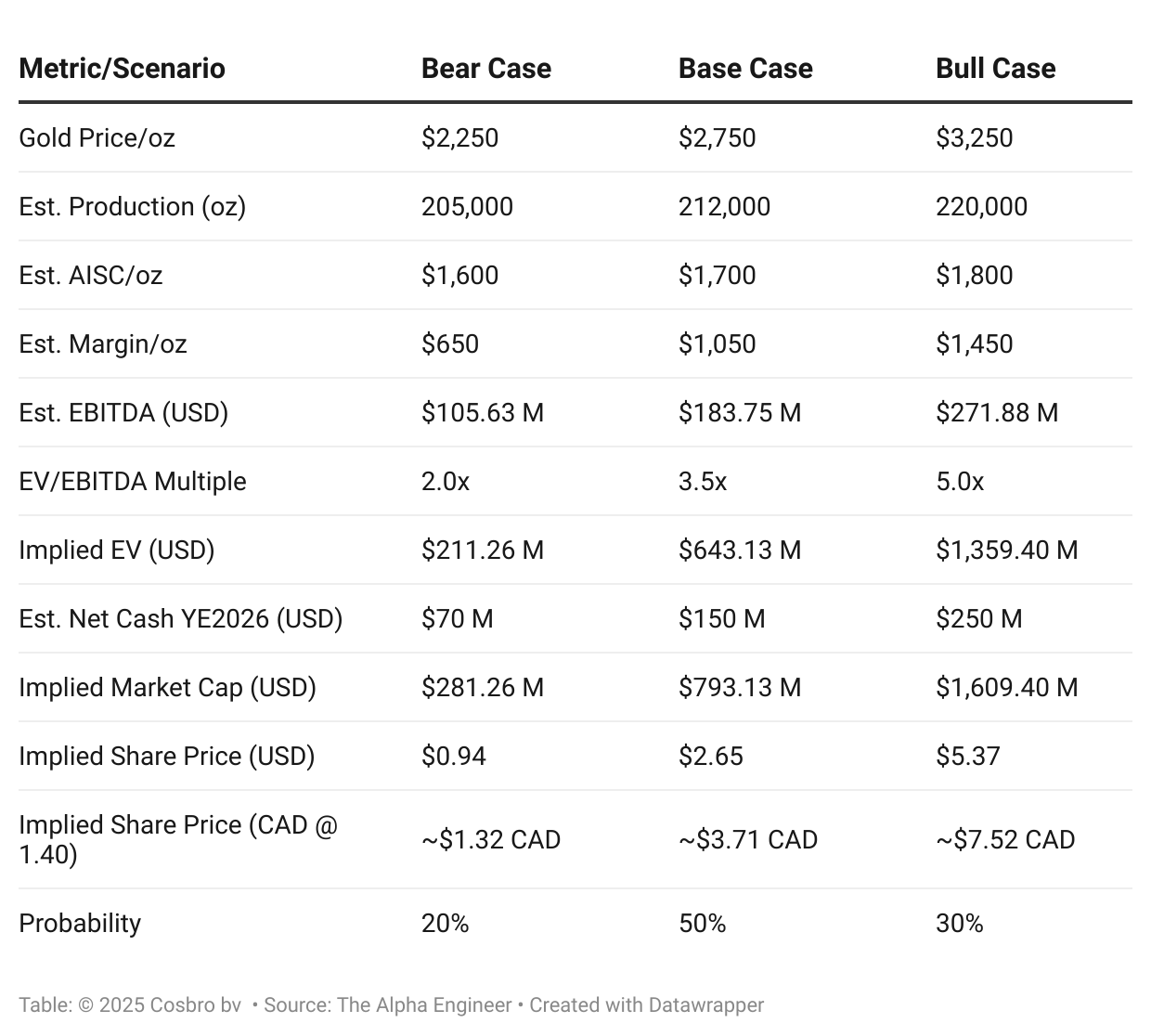

Scenario Analysis

The following scenarios project potential valuations for Mineros SA by the end of Q1 2027, based on estimated year-end 2026 financials, under different gold price assumptions.

Current MSA:CAN price for reference (May 15, 2025): $2.39 CAD.

Deep-Dive Analysis: Serabi Gold PLC

Company Analysis

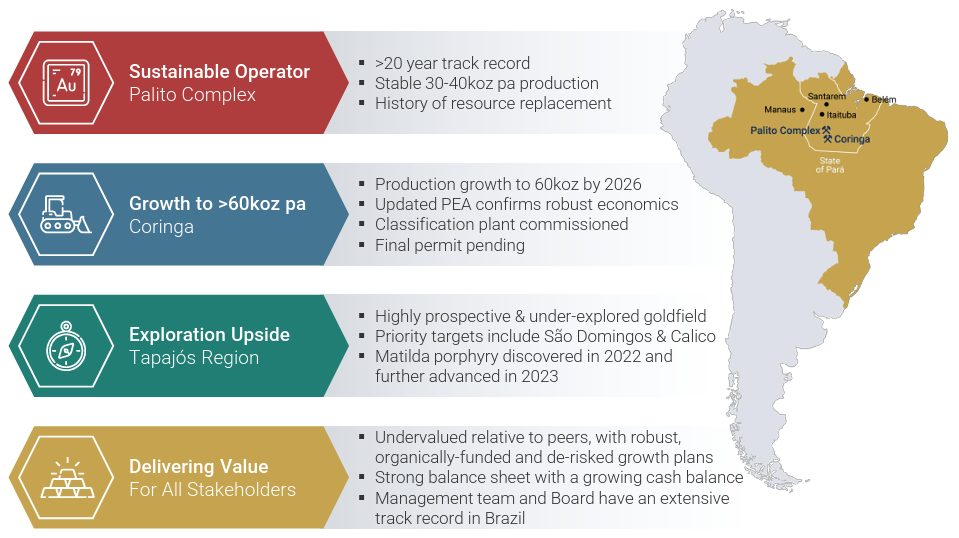

Company Profile: Serabi Gold is a gold exploration, development, and production company focused on the Tapajós region in Pará State, northern Brazil. The company operates the Palito Mining Complex and is advancing the Coringa Gold Project towards full production. Serabi aims to significantly increase its production profile in the coming years.

Operations & Production (as of early 2025):

Palito Complex: Currently the main producing asset, historically delivering 30,000-40,000 oz/year.

Coringa Project: In development and ramp-up. Expected to be a key driver of future production growth. Ore classification plant commissioned.

Q1 2025 Production: 10,013 oz.

2025 Guidance: 44,000 - 47,000 ounces of gold.

Future Targets: Aiming for ~60,000 oz by 2026 and over 100,000 oz thereafter.

Financial Highlights & Costs:

2024 Full Year: Production 37,520 oz. AISC $1,700/oz. Cash Cost $1,326/oz. EBITDA $35.9M. Post-tax profit $27.8M. Net cash $16.2M (end of 2024).

Q1 2025 Cash: $26.5M (Net cash $21.1M).

Shareholder Returns: Announced a new policy to return 20-30% of free cash flow to shareholders.

Valuation (May 15, 2025):

Market Cap GBP 144.1M

P/E 4.99x

EV/EBITDA 3.38x

Price/FCF 11.14x.

Summary of Mine Lives and Exploration for Extension:

Palito Mining Complex: A July 2023 technical report indicated a reserve-based mine life of over 6 years at then-current production rates. Serabi has a history of resource replenishment at Palito, and the 2025 exploration program includes ~14,000 meters of drilling aimed at further resource addition and LOM extension.

Coringa Gold Project: An updated PEA (late 2024) outlined an initial 11-year mine life. The 2025 exploration program includes ~16,000 meters of drilling at Coringa to expand resources. Serabi's broader goal is to grow its consolidated resources to 1.5-2.0 million ounces, significantly extending the operational outlook for both assets.

Strategy & Growth:

Coringa Development: Bringing Coringa to full production is the primary near-term catalyst.

Exploration: Significant $9M exploration program in 2025 across Palito and Coringa aiming to grow consolidated resources substantially.

Organic Growth: Phased approach to becoming a +100,000 oz/year producer.

Key Strengths:

Clear growth pathway centered around the Coringa project.

Operating in a historically prolific gold region (Tapajós) with significant exploration potential.

Improving cash position and a new shareholder return policy.

Experienced management team with a focus on Brazilian operations.

Key Risks:

Coringa Ramp-Up Risk: Execution risk in bringing Coringa to full design capacity and achieving cost targets.

Exploration Dependent Growth: Longer-term growth beyond Coringa's initial ramp-up relies heavily on exploration success.

Jurisdictional Risk (Brazil): Risks include illegal mining activities, environmental regulations, permitting.

Single Country Focus: All operations are currently in Brazil.

Financing for Future Expansion: Larger-scale expansion to >100k oz might require further funding.

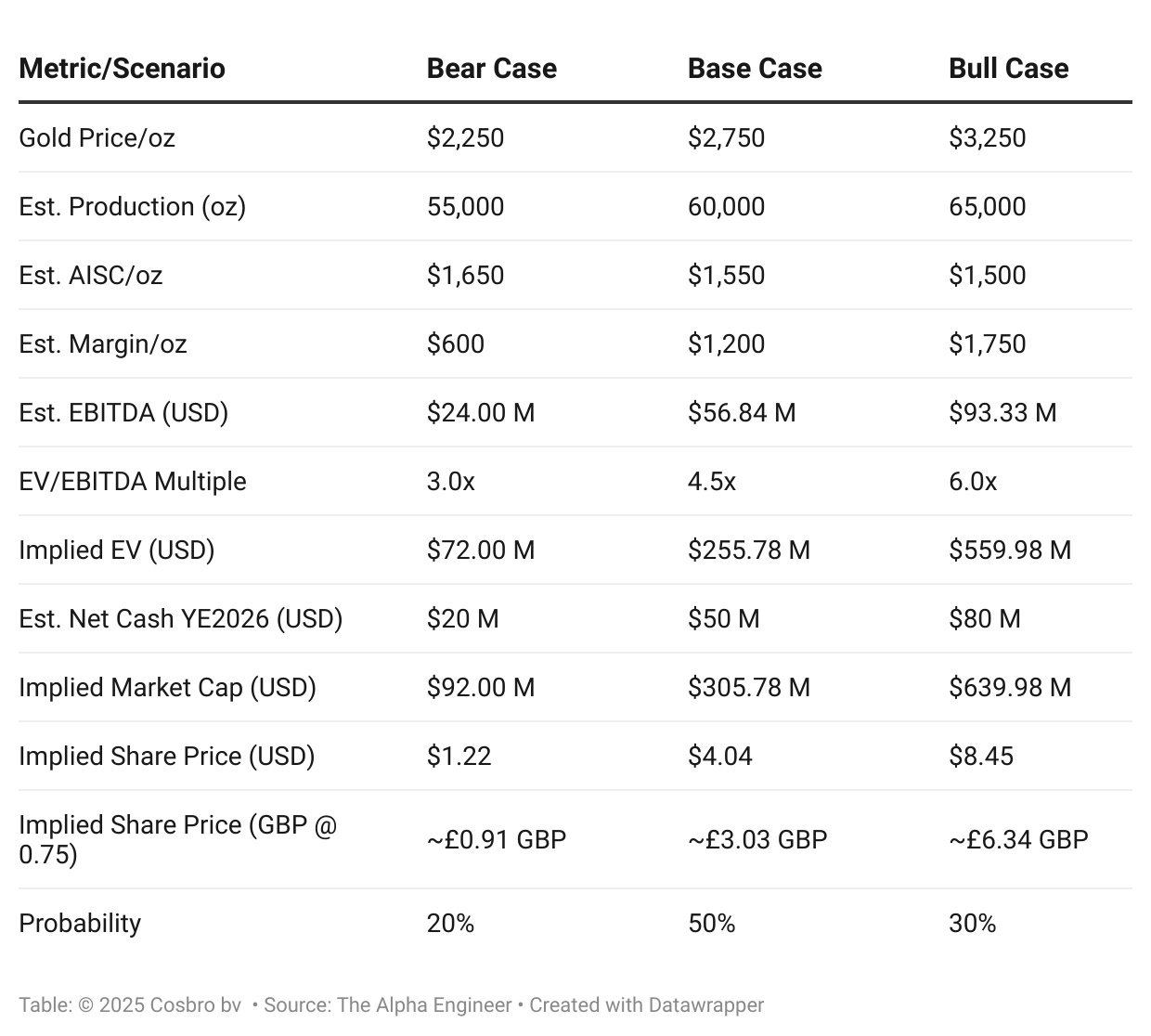

Scenario Analysis

The following scenarios project potential valuations for Serabi Gold by the end of Q1 2027, based on estimated year-end 2026 financials, under different gold price assumptions.

Current SRB:GBR price for reference (May 15, 2025): £1.43 GBP.

General Considerations for Both Companies

Gold Price Leverage: Both companies exhibit significant operational and financial leverage to the gold price. The assumed gold prices in each scenario are the primary driver of the valuation outcomes.

Cost Control: Ability to manage AISC in an inflationary environment and (for MSA) amidst fluctuating gold prices impacting artisanal ore costs, will be critical.

Execution: MSA needs to execute on optimizing its current assets and potentially integrating new M&A. SRB needs to successfully ramp up Coringa and deliver on its exploration programs.

Market Sentiment: Broader market sentiment towards gold and mining equities will influence valuation multiples.

Resource/Reserve Updates: Positive updates on resources and reserves from exploration activities can act as significant catalysts.

Jurisdictional Factors: Operating in Latin America presents both opportunities and risks. Political stability, fiscal regimes, community relations, and security are ongoing considerations.

Probability-Weighted Return Analysis

When we analyze the probability-weighted expected returns for both companies, the potential becomes clear:

For Mineros SA (MSA:CAN):

Bear Case ($1.32 CAD): 20% probability = $0.26 contribution

Base Case ($3.71 CAD): 50% probability = $1.86 contribution

Bull Case ($7.52 CAD): 30% probability = $2.26 contribution

Probability-weighted price target: $4.38 CAD

Current price: $2.39 CAD

Expected return: 83%

Bull case price multiple: 3.15x (215% upside)

For Serabi Gold (SRB:GBR):

Bear Case (£0.91 GBP): 20% probability = £0.18 contribution

Base Case (£3.03 GBP): 50% probability = £1.52 contribution

Bull Case (£6.34 GBP): 30% probability = £1.90 contribution

Probability-weighted price target: £3.60 GBP

Current price: £1.43 GBP

Expected return: 152%

Bull case price multiple: 4.43x (343% upside)

Synthesis

The systematic analysis of these companies reveals that both Mineros and Serabi represent compelling opportunities within the gold mining sector, each with distinct operational characteristics and growth trajectories. While both companies have solid fundamentals and operate in similar market environments, they offer different risk-reward profiles:

Mineros SA presents strong upside potential (83%), benefits from greater geographic diversification across two countries, has a longer operating history, and pays an attractive dividend. Its higher current production level provides more immediate leverage to gold prices.

Serabi Gold offers the higher probability-weighted upside (152%) and a more defined organic growth pathway through its Coringa project, with production potentially more than doubling in the coming years. It may represent a slightly lower jurisdictional risk profile with operations focused in Brazil.

References

Mineros corporate website - https://www.mineros.com.co

Serabi Gold corporate website - https://www.serabigold.com

The Alpha Engineer --- Investing with a quantitative edge

Disclaimer: The Alpha Engineer shares insights from sources I believe are reliable, but I can't guarantee their accuracy---data's only as good as its inputs! This content (whether on Substack, via email newsletters, X, or elsewhere) is for informational and educational purposes only---it's not personalized investment advice. I'm not a registered investment advisor, just an engineer crunching numbers for alpha. My opinions are my own and may shift without notice. Investing involves risks, including the chance of losing money. Past performance, whether from back-testing or historical data, does not guarantee future results---outcomes can vary. So, please consult your financial advisor to see if any strategy fits your situation. Full disclosure: I may own positions in the securities I mention, as I actively manage my own portfolio based on these strategies.