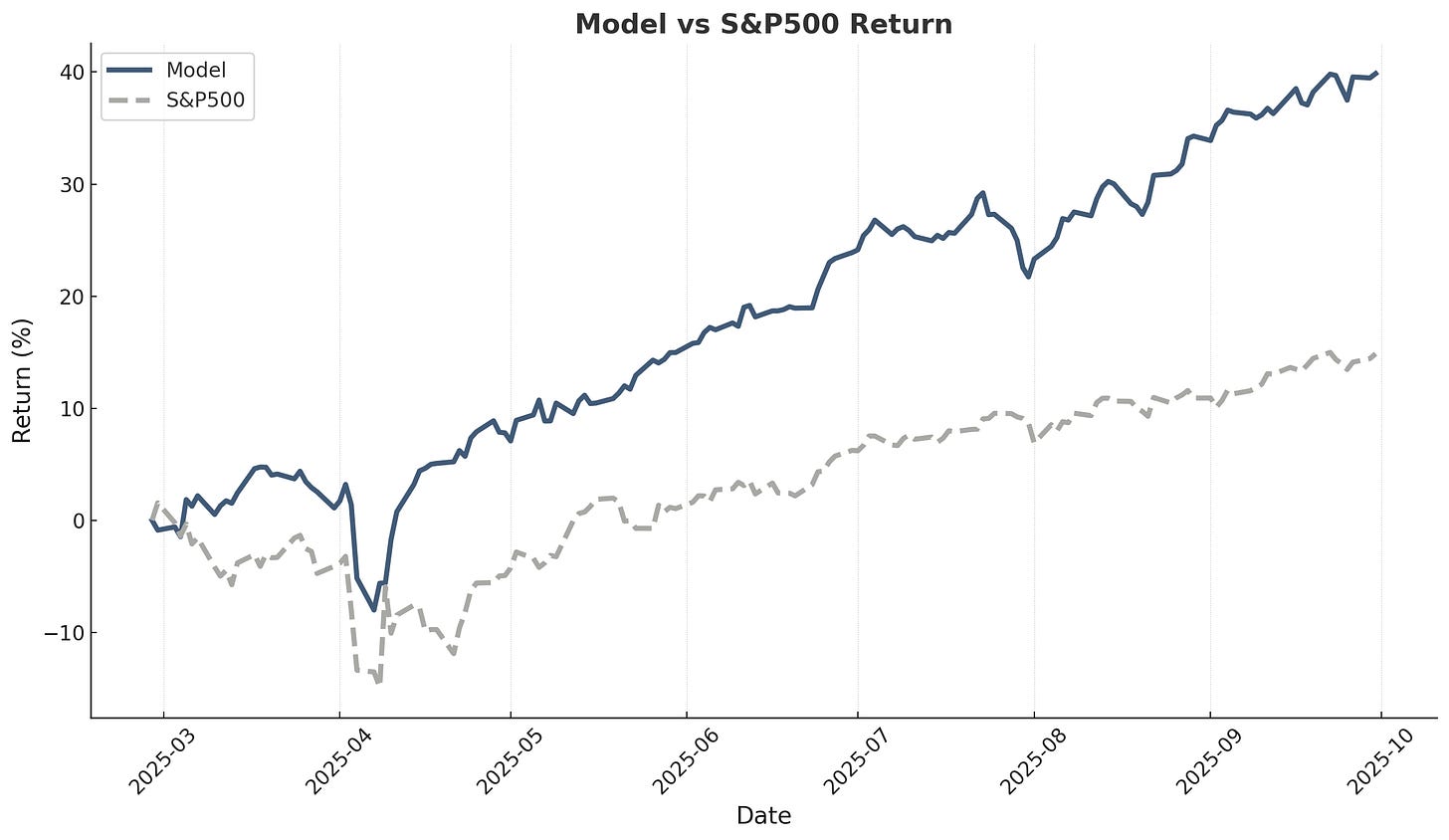

The model portfolio has delivered a 4.2% return in September and 39.9% since inception 7 months ago, outperforming the S&P 500 by 25% in that time frame and beating it 6 months out of 7 months.

Markets in September

September delivered a powerful rally that broke historical seasonal weakness patterns, driven by the Federal Reserve’s first rate cut since December. U.S. equities posted strong gains across the board, with the S&P 500 advancing 3.6% to close at 6,688, the Nasdaq surging 5.6% to 22,660, and the Dow gaining 1.9% to 46,397.

The Fed’s September 17 decision to cut rates by 25 basis points to 4.00%-4.25% catalyzed the rally, characterized by Chair Powell as a “risk management cut” responding to deteriorating labor market conditions. The shocking -911,000 benchmark revision to payrolls—the largest on record—combined with August’s weak +22,000 job gains was justification for the policy pivot despite inflation running at 2.7%-2.9%, well above the 2% target.

European markets participated in the global risk-on sentiment, with the STOXX Europe 600 posting a modest 1.5% gain and reaching a new record high by month-end. The index gained about 10% year-to-date. The EUR/USD remained essentially flat for September, closing at 1.1721, though it touched its 2025 high of 1.1919 mid-month following the Fed announcement.

Model Portfolio Performance

Key Performance Metrics:

Return results:

Total return (7 months): 39.9%

S&P 500 return (same period): 14.9%

Alpha generated: 25.0%

Quarterly beats: 3 of 3 (100%)

Realized trades:

Win rate: 57% of 56 trades

Average return: 12.2%

Average days held: 101 days

Portfolio turnover: 110% (first 7 months)

Model Portfolio Holdings

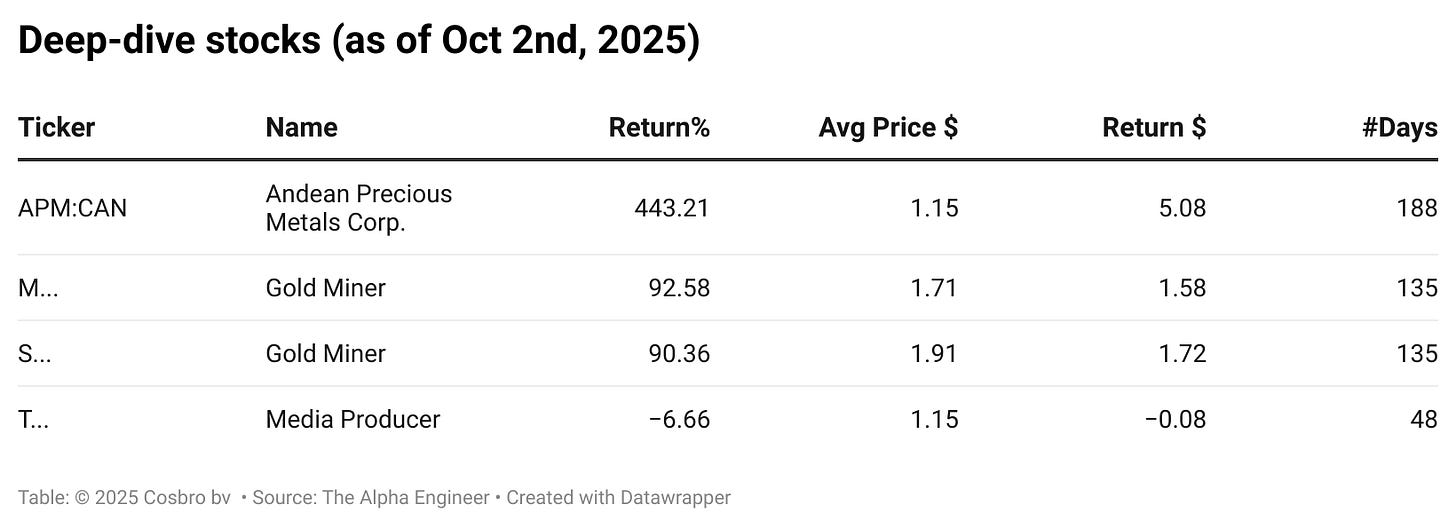

The portfolio's current largest position (8.3%) is gold and silver miner APM, a deep-dive stock that is currently 499% up since entry. It currently holds another multibagger. Two deep-dive stocks are up 82% and 85% in the portfolio. The portfolio currently has 5 realized trades with +88% returns (112.7% gain on average) and 5 trades with -39% returns (45.6% loss on average).

Deep-Dive Stock Performance

My deep-dive stocks are an additional service for my paid subscribers. I do a much deeper quantitative and qualitative analysis for a selection of top-ranked stocks. I try to come up with a new ideas every 1-2 months, but it is always subject to finding good ideas that have the potential to outperform the model portfolio (which sets a very high bar). All deep-dive stocks have a bear, base, and bull case target and estimated probability. They are reviewed after one year and held on the list for another year if the potential upside is still there. I notify personal trades in deep-dive stocks in our paid subscribers chat.

For a summary of the results, see below: