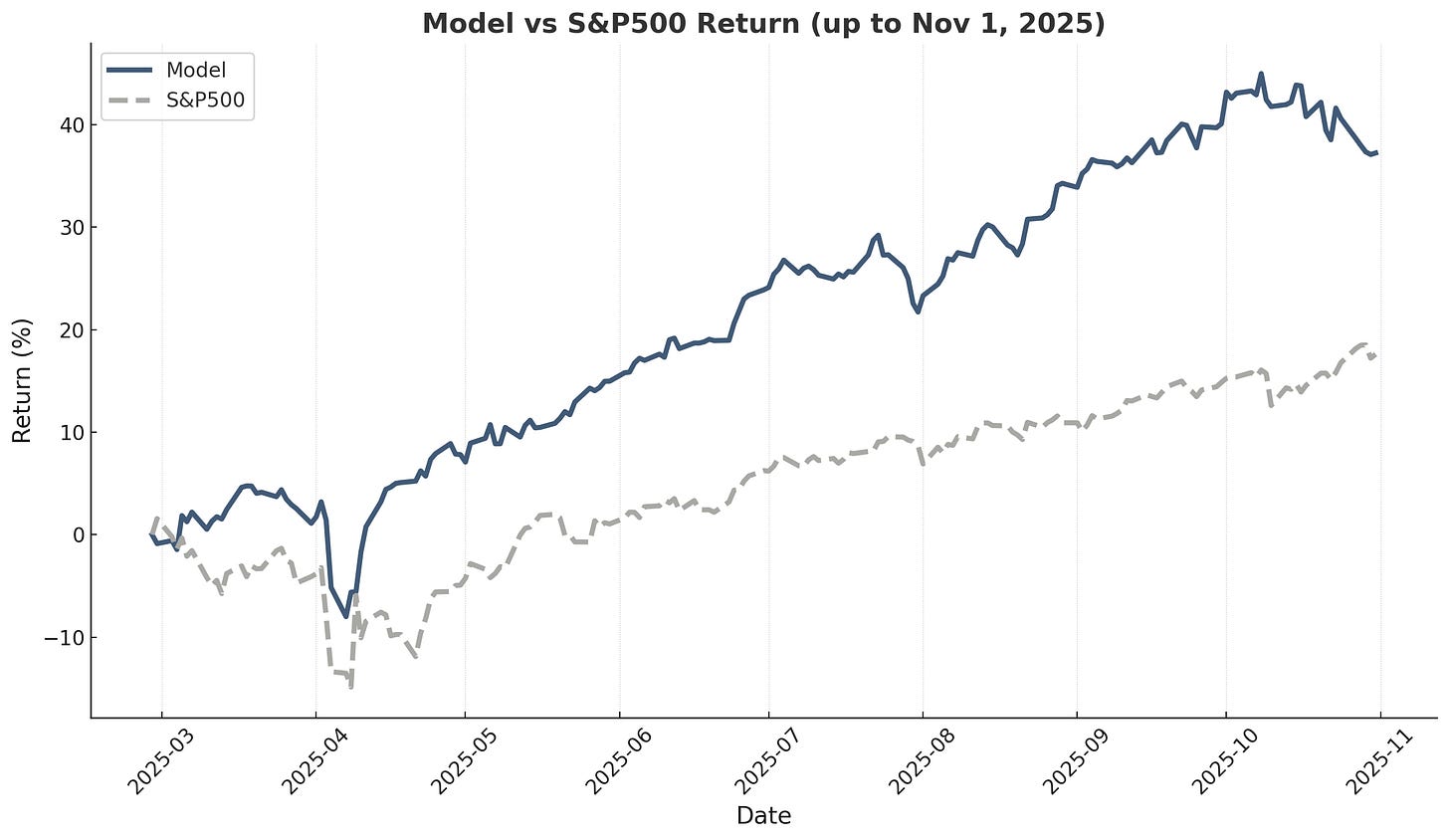

The model portfolio delivered -2% in October and +36.9% since inception 8 months ago, outperforming the S&P 500 by 19.1 percentage points over that period and beating the index in 6 of 8 months. October marked the portfolio’s worst performance to date in both absolute and relative terms, driven primarily by the underperformance of micro- and small caps and the sharp decline in precious metal miners.

Markets in October

October extended the risk-on run but with a big leadership gap. U.S. large caps notched fresh highs—S&P 500 +2.3% to close at 6,840, Nasdaq +4.7% to 23,725, and Dow +2.5% to 47,563—driven by strong Big Tech earnings and ongoing AI capex momentum.

Under the surface, small and micro caps took a hit. In the U.S., small caps lagged, and micro caps were whipsawed—the Russell Microcap Index fell ~3% on Oct 13 (its steepest drop since April) before rebounding somewhat into month-end. European small caps slipped about -1% for the month.

After a relentless rise this year, precious-metal miners finally cracked. Gold saw its biggest one-day plunge in 12 years on Oct 21. Gold-miner ETFs fell roughly 6-8% in October, with continued pressure spilling into early November. Silver-miner funds faded as well.

FX backdrop turned dollar-friendly: EUR/USD slid from ~1.17 at the start of October to ~1.157 by month-end.

Model Portfolio Performance

Key Performance Metrics:

Return results (as of Nov 1):

Total return (8 months): 36.9%

S&P 500 return (same period): 17.8%

Alpha generated: 19.1%

Monthly beats: 6 of 8 (75%)

Realized trades (as of Nov 4):

Win rate: 56% of 61 trades

Average return: 11%

Average days held: 102 days

Portfolio turnover: 119% (first 8 months)

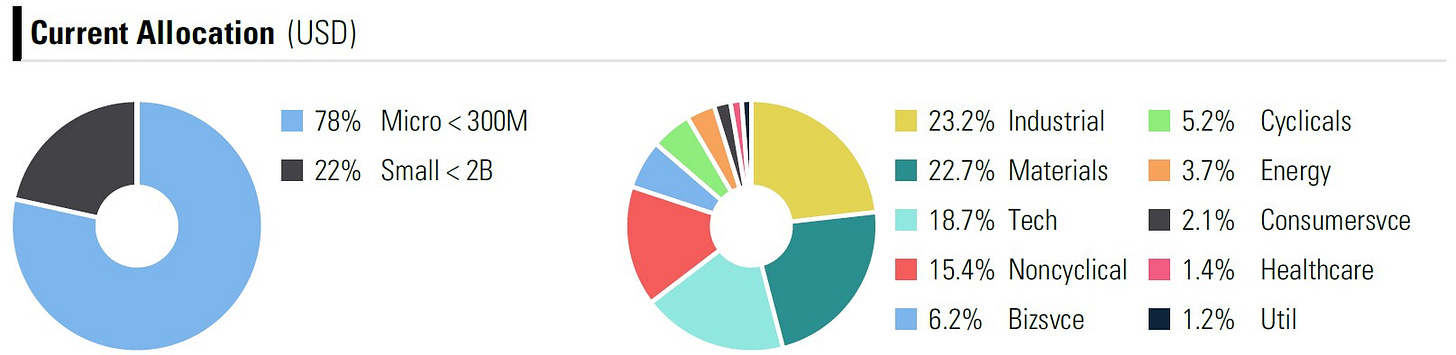

Model Portfolio Holdings

As of November 4th, the portfolio's current largest position (6.2%) is gold and silver miner APM, a deep-dive stock that is currently 309% up since entry. It currently holds two other multibaggers (a gold miner and a European industrial stock). Two deep-dive stocks are up 60% and 75% in the portfolio. The portfolio currently has 5 realized trades with +88% returns (112.7% gain on average) and 5 trades with -39% returns (45.6% loss on average).

Deep-Dive Stock Performance

My deep-dive stocks are an additional service for my paid subscribers. I do a much deeper quantitative and qualitative analysis for a selection of top-ranked stocks. I try to come up with a new ideas every 1-2 months, but it is always subject to finding good ideas that have the potential to outperform the model portfolio (which sets a very high bar). All deep-dive stocks have a bear, base, and bull case target and estimated probability. They are reviewed after one year and held on the list for another year if the potential upside is still there. I notify personal trades in deep-dive stocks in our paid subscribers chat.