About The Alpha Engineer

From Value Investor to Quant Engineer: Finding Alpha Where Others Don't Look

Hello, I'm Peter, the founder of The Alpha Engineer. For over 20 years, I've been applying my analytical engineering mindset to the world of investing. As a former tech entrepreneur who built a pioneering firm in drone technology, I've now turned my problem-solving skills to a different challenge: how can individual investors consistently outperform the market using a quantitative approach?

The Problem: Limited Options for DIY Investors

If you're managing your family funds or personal portfolio, you're facing a challenging environment:

Passive index investing worked well for American indices in recent decades, but as Japan in the 90s and Europe in the 2010s demonstrated, lost decades are not uncommon. The current macro environment suggests the past may not resemble the future.

Active fund managers rarely beat their benchmarks consistently, as most end up tracking indices to avoid career risk.

DIY stock picking requires significant knowledge, experience, and time---especially if you're focusing on the same mid and large-cap stocks that everyone else (including the "gurus") is analyzing.

Most DIY investors end up focusing on dividend investing or "moat" stocks---the same pool of well-known companies that professional investors target. While this approach may seem prudent, it inherently limits your returns.

Warren Buffett famously suggested that if he were managing a smaller portfolio, he could achieve 50% returns, much higher returns than the roughly 12% he's delivered in recent years. The reason: smaller portfolios can access opportunities that large funds cannot.

Beyond the structural challenges, our own behavior often sabotages our returns. Without a systematic approach, investors get caught up in the market's emotional swings, leading to subpar performance. Studies show that over the past two decades, the average DIY investor achieved only 5-7% annual returns---significantly below the S&P 500's performance during the same period. Market timing and emotional decision-making make things worse for most investors.

My Journey: Two Decades of Investment Discovery

My investment journey has taken many turns. When I began more than 20 years ago, I was like many novice investors---chasing exciting growth stories without a systematic approach. I once bought Netflix based on a newsletter recommendation, only to sell it shortly after. Had I held onto it, that single position would have returned 250x my investment.

But this is just hindsight bias. What made Netflix so compelling that I had to hold on to it for 20 years? Without deep insights (difficult for a DIY investor), it mainly comes down to deep conviction---and in most cases, this equates to luck.

In 2012, after selling my drone business, I had significant funds to manage for my family. I doubled down on value investing---studying guru recommendations, analyzing 10-Ks, subscribing to Value Line, and testing mechanical approaches like Greenblatt's "Magic Formula."

The results were reasonable but underwhelming, as I trailed the US indices by a wide margin.

Everything changed in 2016 when I finally understood that micro- and small-caps offer the biggest potential returns for individual investors like myself. The inefficient part of the market is the long tail of thousands of stocks that large investors (and most investors in general) would never touch.

I began with net-net investing, a method developed by Benjamin Graham that looks for companies selling for a fraction of their net current asset value. While applying this in Japan, my portfolio gained +130% (in EUR) in just two years, with three outliers accounting for half the gains: Sec Carbon (541%), Leader Electronics (334%), and Yotai Refractories (173%).

The next two years brought volatility as the global economy slowed and the pandemic hit, with drop and recovery but it still delivered a compounded annual growth rate (CAGR) over 5 years of almost 25%.

During the pandemic, I had ample time to experiment with backtesting tools and explore academic research. I developed and refined a quantitative model that could identify alpha opportunities in the most inefficient corners of the market. This work gave me the same mental boost I experienced when developing drones---systematically solving complex problems through engineering principles.

The Solution: A Systematic Engineering Approach to Stock Selection

The Alpha Engineer model systematically generates alpha with managed downside risk by leveraging quant research and insights from successful investors, addressing market inefficiencies, and using robust models validated through rigorous backtesting.

My high-level approach focuses on three fundamental drivers of excess returns:

Small Market Cap --- Markets become less efficient as stock size decreases. Smaller stocks receive less analyst coverage, are overlooked by institutions, and often harbor hidden opportunities.

Value --- Stocks with strong valuation metrics provide asymmetric returns, offering more upside potential than downside risk.

Momentum --- Favoring stocks that already demonstrate strength enhances returns, through both fundamental momentum (earnings, sales growth) and technical momentum (price trends).

My model has delivered impressive backtested results based on a disciplined portfolio management approach: maintaining a 50-stock portfolio and only selling when a stock drops out of the top 10% of the overall stock ranking. This systematic approach produced:

48.3% CAGR over 5 years (vs. 16.6% for the S&P 500)

36.2% CAGR over 10 years (vs. 12.9% for the S&P 500)

36.4% CAGR over 15 years (vs. 13.7% for the S&P 500)

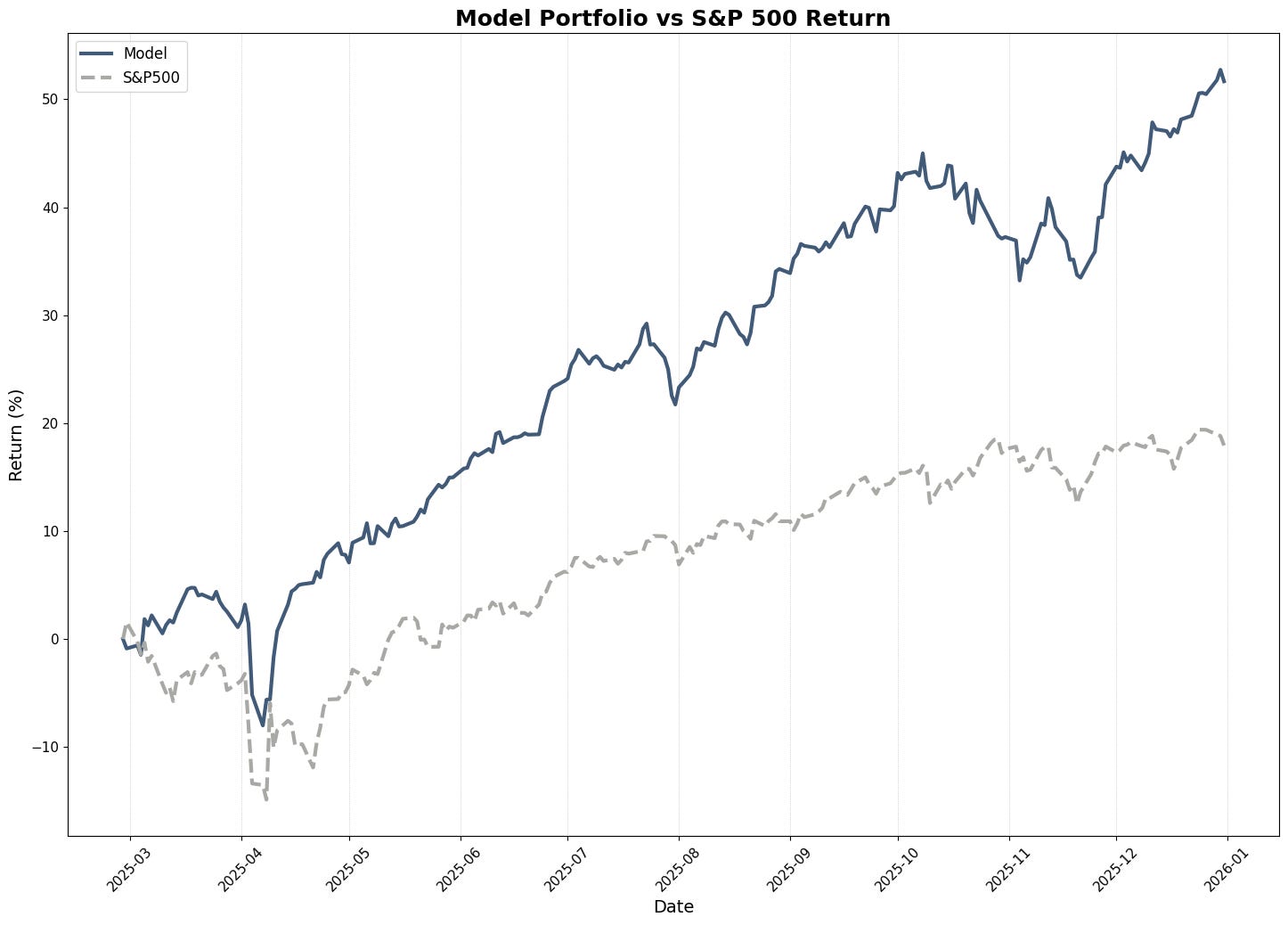

For the full year since inception on February 28th, the model generated +51.7% total return versus +17.9% for the S&P 500—outperforming the benchmark by 33.8 percentage points in just ten months.

One of the drivers of the model's success is its ability to capture multibagger stocks. About 7-8% of the top 100 ranked stocks reach +100% returns on average in less than 1 year and about 15% of the top 100 ranked stocks reach +100% in less than 2 years. The weekly updated Alpha Engineer stock ranking is a treasure trove to find them. I present potential multibaggers in regular deep-dives. The average return across the seven deep-dives of 2025 stands at +108%, with four positions added in Q3 or earlier averaging +186%. Three of those four are multibaggers, led by APM (Andean Precious Metals) at nearly +500%.

Following my model and deep-dive selection, my personal ‘Alpha Engineer’ portfolio achieved a return of +74.73% in 2025 (euro denominated, measured from January 1st to December 31st, as I started prior to the launch of The Alpha Engineer).

Subscribe and Join The Alpha Engineer Community

Paid Subscription Benefits:

Weekly Stock Rankings — My proprietary ranking of approximately 3,700 stocks updated every week, covering US, European, UK, and Canadian markets.

Methodology & Tools — Access to my complete methodology, portfolio manager tool, and ongoing research for implementation.

Model Portfolio — Full transparency on the 50-stock portfolio transactions and performance tracking.

Deep-Dive Analysis — Detailed research on potential multibagger candidates that survive both quantitative and qualitative filters.

Direct Access — Reach me via direct message and the paid subscriber chat, where I share what I’m working on, flag upcoming articles, and announce when I buy or sell deep-dive positions in real time.

Ready to stop limiting your investment returns and start finding alpha where others aren't looking? Subscribe today and join me in exploring the inefficient corners of the market where individual investors have a distinct advantage over the big funds.

Learn more about my investing framework:

Read about my overall portfolio strategy.

See the full details of my systematic method for stock picking.

The Alpha Engineer --- Investing with a quantitative edge

Disclaimer: The Alpha Engineer shares insights from sources I believe are reliable, but I can't guarantee their accuracy---data's only as good as its inputs! This content (whether on Substack, via email newsletters, X, or elsewhere) is for informational and educational purposes only---it's not personalized investment advice. I'm not a registered investment advisor, just an engineer crunching numbers for alpha. My opinions are my own and may shift without notice. Investing involves risks, including the chance of losing money. Past performance, whether from back-testing or historical data, does not guarantee future results---outcomes can vary. So, please consult your financial advisor to see if any strategy fits your situation. Full disclosure: I may own positions in the securities I mention, as I actively manage my own portfolio based on these strategies.