The Alpha Engineer Stock Ranking of +3700 stocks is provided weekly to paid subscribers. Stocks entering the top 5% of the ranking are provided to all subscribers.

For details on how these rankings are utilized in both my personal portfolio and The Alpha Engineer Model Portfolio, check out the methodology. My method section provides additional tools and context, while my research demonstrates how the method can be customized to individual preferences.

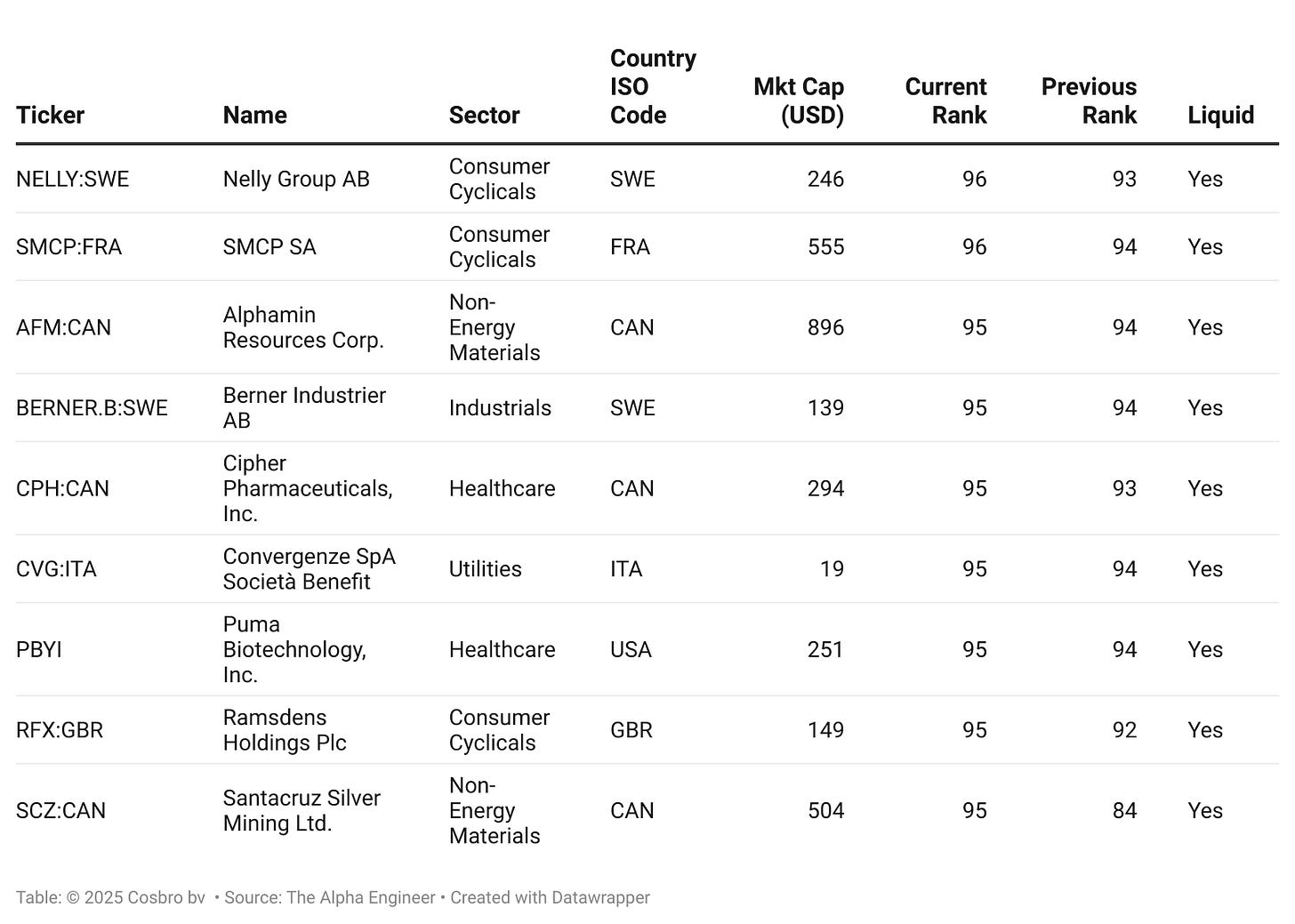

New top stocks

Understanding the Ranking Terms

Ticker – Every stock is identified by its primary ticker, based on the country where most of its trading occurs. Non-US stocks include a colon followed by a three-letter country ISO code.

Name – The official company name.

Sector – The primary industry sector of the company. While it's useful to ensure portfolio diversification, I don’t actively manage sector weights.

Country ISO Code – A three-letter ISO standard country code (more details here). My model covers stocks globally to maximize opportunities and minimize market risk, but individual investors can adjust the universe based on personal preference or brokerage limitations.

Market Cap (USD) – Market capitalization in USD. My strategy primarily targets microcaps (below $300M) and small caps (below $2B). Typically, the model portfolio consists of approximately 80% microcaps and 20% small caps. Note: Microcaps, particularly those between $20M and $50M (nanocaps), are significant contributors to excess returns.

Current Rank – The stock’s position in the latest weekly ranking.

Previous Rank – The stock’s ranking position in the prior update.

Liquid – Indicates whether the stock has an average liquidity greater than $50K USD and a stock price above $0.50 USD over the past two weeks.