This post outlines The Alpha Engineer method – my quantitative approach for systematically selecting and managing individual stocks. This method is the most important component of my broader investment approach, which I detail in a separate post on my overall investment philosophy and portfolio allocation strategy. For more information on how I developed this method, check my blog post about Engineering Alpha.

My Universe of Stocks

My quantitative model casts a wide net, analyzing nearly 15,000 stocks across the US, Canada, the UK, Europe, Norway, Switzerland, and Israel. From this vast universe, I identify approximately 3,700 stocks that meet specific market and quality constraints (e.g. No OTC stocks, acceptable leverage etc.). About 2,500 of these are what I consider "liquid" – trading with at least $50,000 average daily volume and a price above $0.5. Nearly all are accessible through Interactive Brokers, my primary brokerage.

My Ranking System

I apply a multi-factor ranking to these 3,700 qualified stocks, focusing on the metrics that have historically generated the strongest alpha. The top 5% of this ranking contains about 50 liquid stocks, which forms the potential buy list. I update the entire ranking weekly to ensure I'm always working with the most current data. Check my ranking example for a typical weekly stock ranking post.

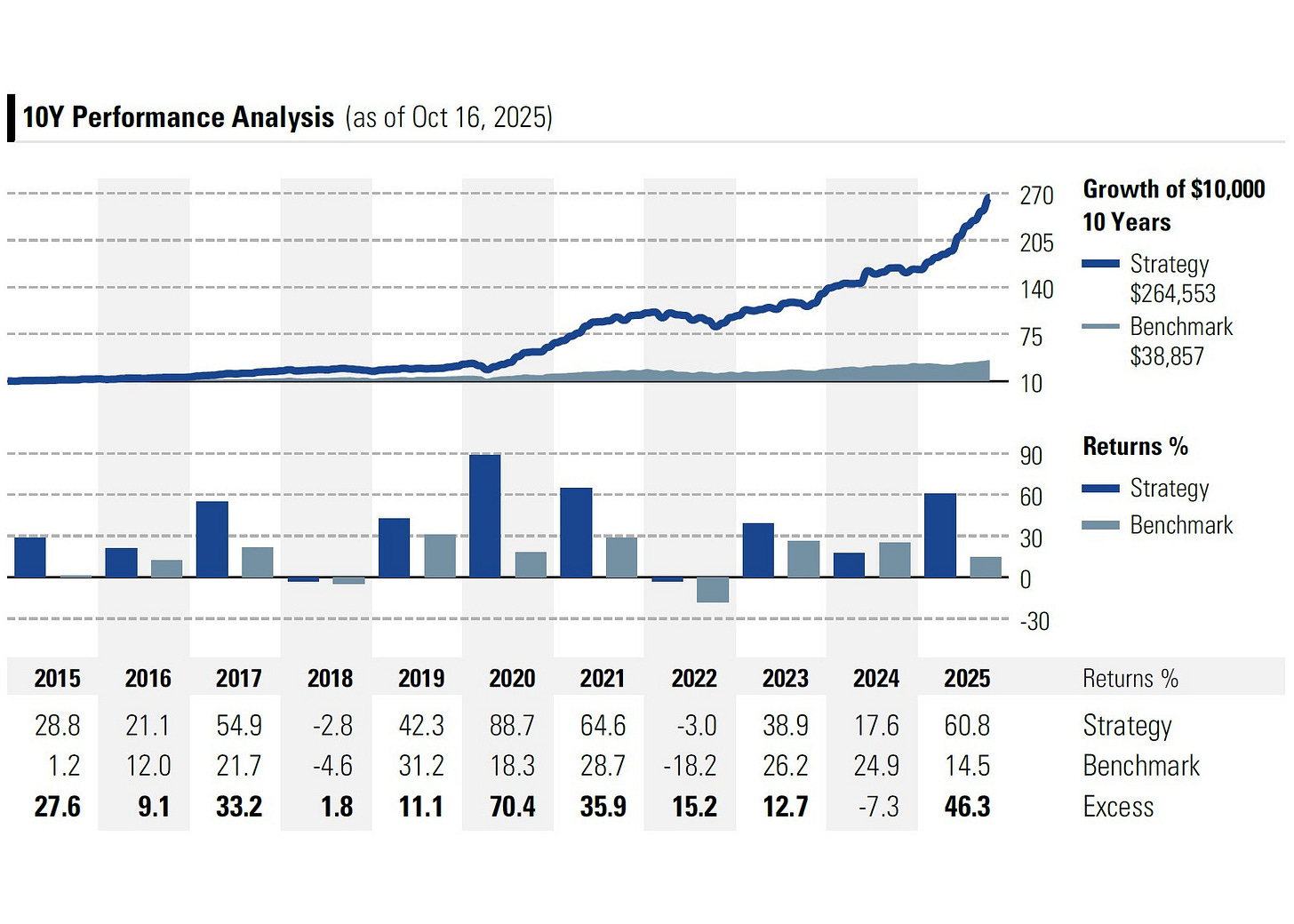

The graph below shows the performance of a purely mechanical strategy: buying the top 50 liquid stocks and selling them when they drop below a certain ranking threshold (or drop from the ranking). This approach demonstrates the power of the "quantitative edge" without any subjective input. I track this 50-stock model portfolio as a benchmark to showcase the strategy’s average performance. All transactions for this benchmark portfolio are provided on Sunday prior to buying or selling on Monday, and you can follow its performance in the Portfolio section. Subscribe for access.

Adding a Qualitative Edge

My main stock portfolio follows a purely quantitative approach – buying the top-ranked stocks without subjective judgment. However, I also maintain a separate, smaller “deep-dive” stock portfolio where I conduct detailed qualitative research on select top-ranked stocks. This additional analysis helps me identify potential multi-baggers – stocks with +100% upside potential – which I showcase in detailed analyses in the Deep-Dive section. This approach allows me to benefit from both the systematic edge of the quantitative model and the deeper insights that come from thorough company research. For more detailed information, check my process for deep-dive reports.

Portfolio Construction

For my main portfolio, I maintain 20 stocks – a sweet spot I've found through years of testing. A smaller portfolio increases volatility, while a larger one becomes unwieldy to manage. You could reasonably go with 15 or 25 stocks as well, depending on your preferences.

My Buy Process

With proceeds from sales, I purchase new stocks from the buy list. I allow position sizes to reach up to 1.5x the ideal allocation (5% for a 20-stock portfolio). This means the maximum position size for a new purchase would be 7.5%. I keep any remaining cash and dividend income in reserve for future opportunities.

My Sell Strategy

I sell stocks when their ranking falls below my threshold or when they drop from the ranking entirely (no longer have a ranking).

The selling threshold directly impacts portfolio turnover and performance. For a threshold between 90% and 70%, turnover varies roughly between 200% to 100%. Finding the right balance depends on transaction costs, tax situation, and the time available to manage the portfolio.

A Weekly Schedule

I follow a weekly schedule for transactions based on the updated ranking. Alternatively, reviewing every 2, 3, or 4 weeks (or monthly) is possible, typically with up to a few % reduction in performance but also reduced time commitment.

My approach is essentially "set and forget" for each transaction:

I set limit orders at or near the closing price

I don't chase stocks if my orders don't fill

I wait for the next ranking update to reassess

I'm comfortable holding partial positions when necessary

My Weekly Process in a Nutshell

Each Monday: Review the updated ranking of stocks

Sell: Any stocks that have fallen below my ranking threshold or are filtered out (or occasionally to make room for an exceptional new opportunity)

Buy: New top-ranked stocks with the proceeds

Up to 1.5x the nominal position size

Nominal position size = portfolio value ÷ number of stocks

This disciplined, systematic approach removes emotion from the investment process and lets the quantitative edge work in my favor over time.

Fine-Tuning to Personal Preferences

While the core methodology is systematic, several parameters can be adjusted to match your personal situation – including portfolio size, sell threshold, and transaction frequency. I’ve written a detailed guide on how to fine-tune the method to your preferences, and you’ll find additional research on optimization approaches in the Research section.

To make implementation as straightforward as possible, I provide the Portfolio Manager tool, which guides you through the weekly stock transactions based on the updated rankings. I also have an FAQ page. I’ll update this regularly as new questions arise.

Paid Subscription Benefits:

Weekly Stock Rankings — My proprietary ranking of approximately 3,700 stocks updated every week, covering US, European, UK, and Canadian markets.

Methodology & Tools — Access to my complete methodology, portfolio manager tool, and ongoing research for implementation.

Model Portfolio — Full transparency on the 50-stock portfolio transactions and performance tracking.

Deep-Dive Analysis — Detailed research on potential multibagger candidates that survive both quantitative and qualitative filters.

Direct Access — Reach me via direct message and the paid subscriber chat, where I share what I’m working on, flag upcoming articles, and announce when I buy or sell deep-dive positions in real time.

The Alpha Engineer --- Investing with a quantitative edge

Disclaimer: The Alpha Engineer shares insights from sources I believe are reliable, but I can't guarantee their accuracy---data's only as good as its inputs! This content (whether on Substack, via email newsletters, X, or elsewhere) is for informational and educational purposes only---it's not personalized investment advice. I'm not a registered investment advisor, just an engineer crunching numbers for alpha. My opinions are my own and may shift without notice. Investing involves risks, including the chance of losing money. Past performance, whether from back-testing or historical data, does not guarantee future results---outcomes can vary. So, please consult your financial advisor to see if any strategy fits your situation. Full disclosure: I may own positions in the securities I mention, as I actively manage my own portfolio based on these strategies.