Market Overview

July 2025 Market Section U.S. markets delivered solid gains in July despite trade tensions and Federal Reserve uncertainty, with the month dominated by the announcement of a draft U.S.-EU trade deal that set European tariffs at 15% on most goods, averting a threatened 30% rate but leaving some details unresolved.

The S&P 500 gained about 2.3% in July, reaching multiple record highs. The Nasdaq Composite outperformed with 4.6%, notching its 15th record close as AI earnings from Microsoft and Meta provided late-month momentum. The Dow returned -0.9%, hampered by trade-sensitive industrial sectors.

The month's defining moment came July 27th when President Trump announced a draft trade agreement with the European Union following talks with Commission President Ursula von der Leyen in Scotland. The deal proposed 15% tariffs on most European goods entering the U.S., including automobiles and pharmaceuticals—a significant de-escalation from the threatened 30% rate—while maintaining higher tariffs like 50% on steel and aluminum. The EU also agreed to purchase $750 billion worth of U.S. energy and invest an additional $600 billion into the U.S., providing substantial commitments that calmed market nerves, though discrepancies in the details emerged and key aspects remain to be finalized.

The Federal Reserve held rates steady at 4.25%-4.50% for the fifth consecutive meeting despite Trump's pressure for cuts. Fed Chair Powell emphasized that the central bank has room to hold rates steady for a period and wait to see how much tariffs impact the economy, underscoring the central bank's cautious, data-dependent approach.

European markets faced significant headwinds throughout July as the Trump tariff threat weighed heavily on sentiment. The pan-European STOXX 600 returned 0.9% in July, with tariff-sensitive sectors like automobiles and retail leading declines early on.

The euro weakened significantly against the dollar during July, falling about 3.0% to reach 1.145 by month-end as trade uncertainty and the eventual tariff agreement pressured the currency.

In dollar terms, the STOXX 600's return was approximately -2.1% for the month, reflecting the dual impact of modest local stock gains offset by currency headwinds for dollar-based investors.

Portfolio Performance

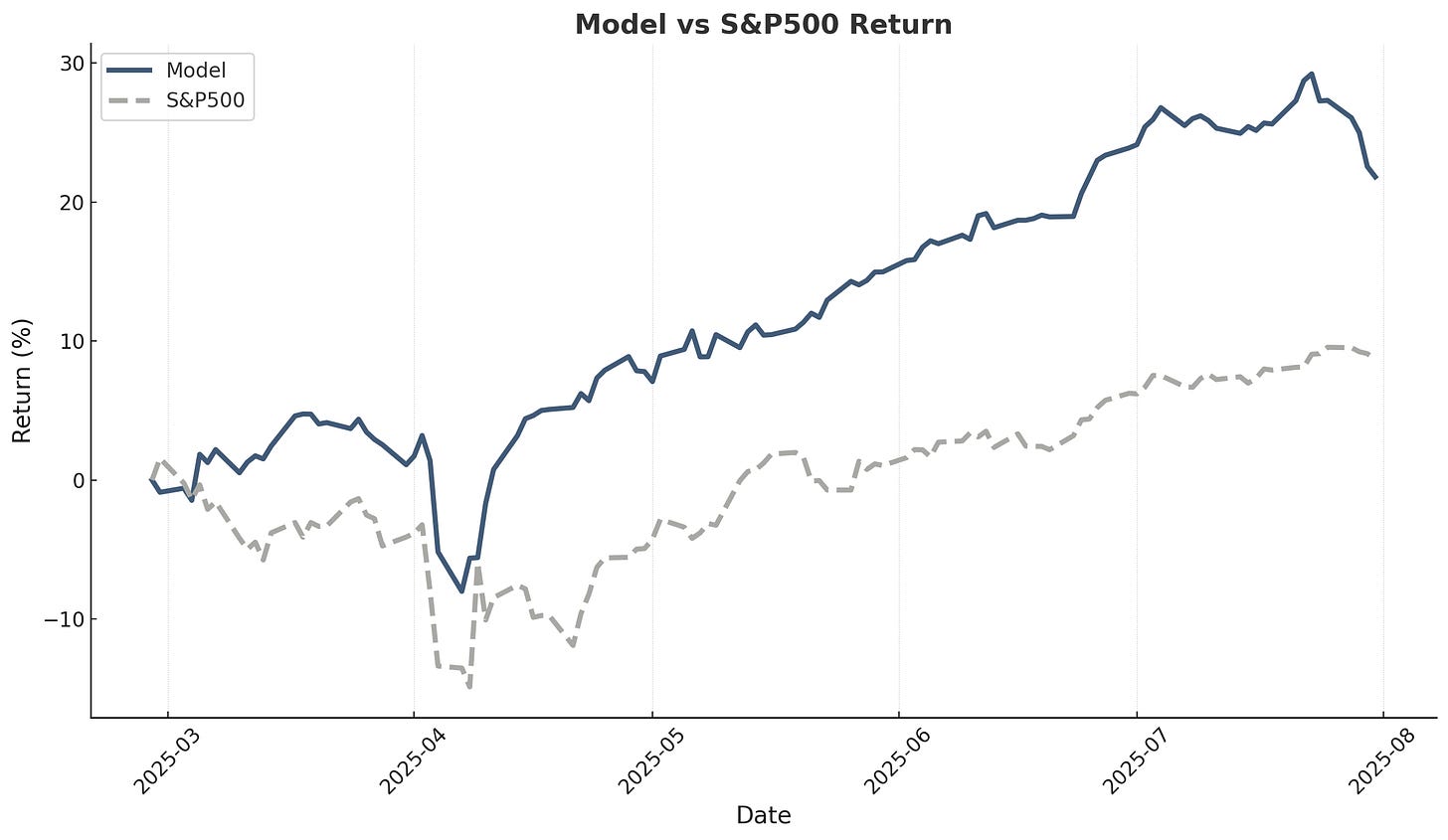

The Alpha Engineer model portfolio peaked in mid-July with nearly 30% returns since inception, but faced headwinds from escalating trade tensions, particularly in the final week of the month. The model delivered -1.7% in dollar terms during July, tracking closely with European equities given its current 80% European concentration. While the model underperformed the S&P 500 by 4% this month, it maintains a substantial edge since inception with 21.8% gains versus the S&P 500's 9.1% return.

Deep-Dive Performance

Below is the current performance overview of stocks previously featured in in-depth research analyses, including their current results and estimated targets. The three stocks returned 122%, 6% and 26% respectively since their deep-dive report: