A Strong Start

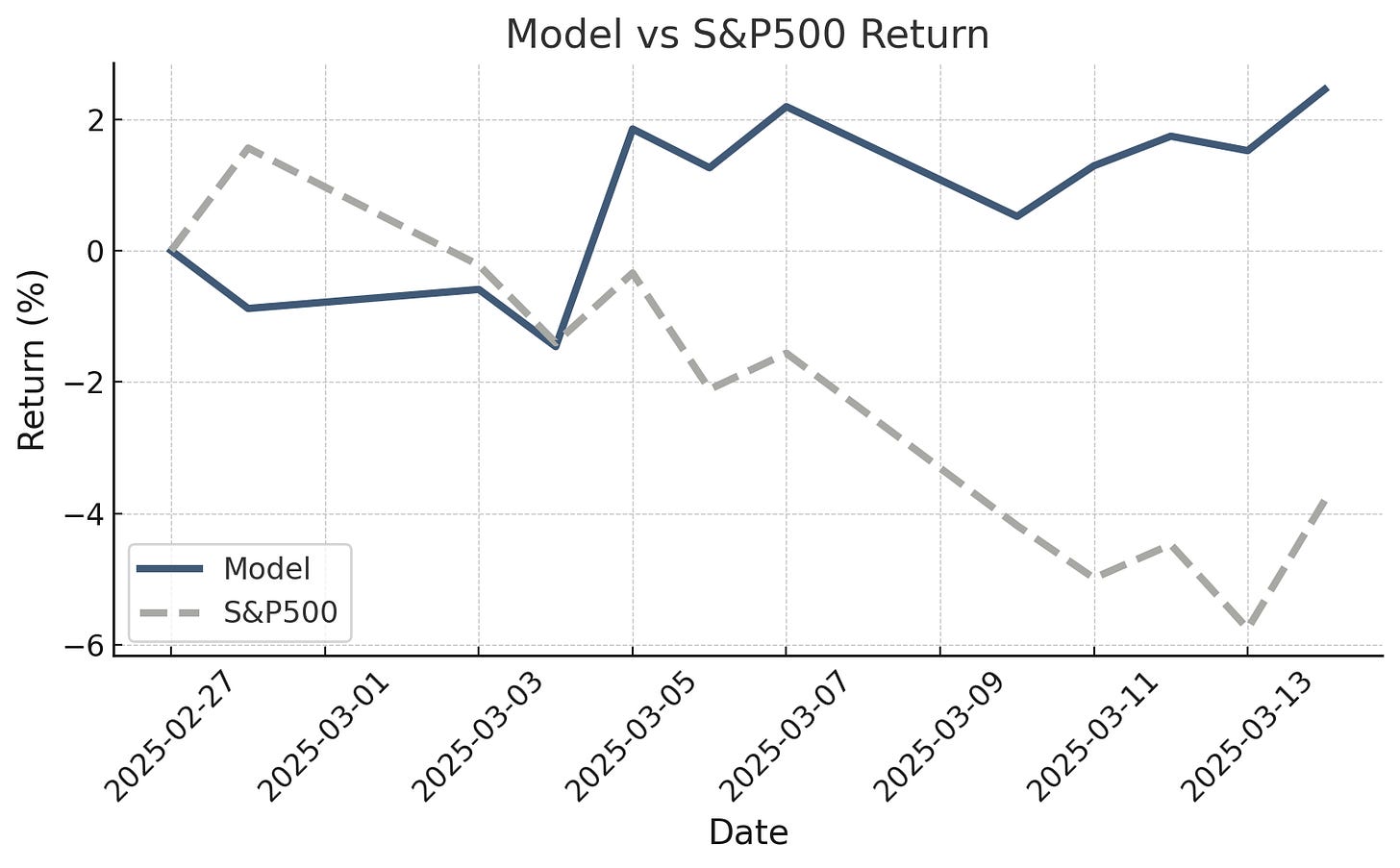

From its official start on February 27th onward, the Alpha Engineer Model Portfolio achieved remarkable outperformance compared to the S&P500. While the S&P500 declined notably, the portfolio demonstrated resilience and delivered positive returns.

While a period of 2 weeks is short, it illustrates a few important "built-in" features versus general market indices (and their popular trackers) such as the S&P500.

Diversified Regional Exposure

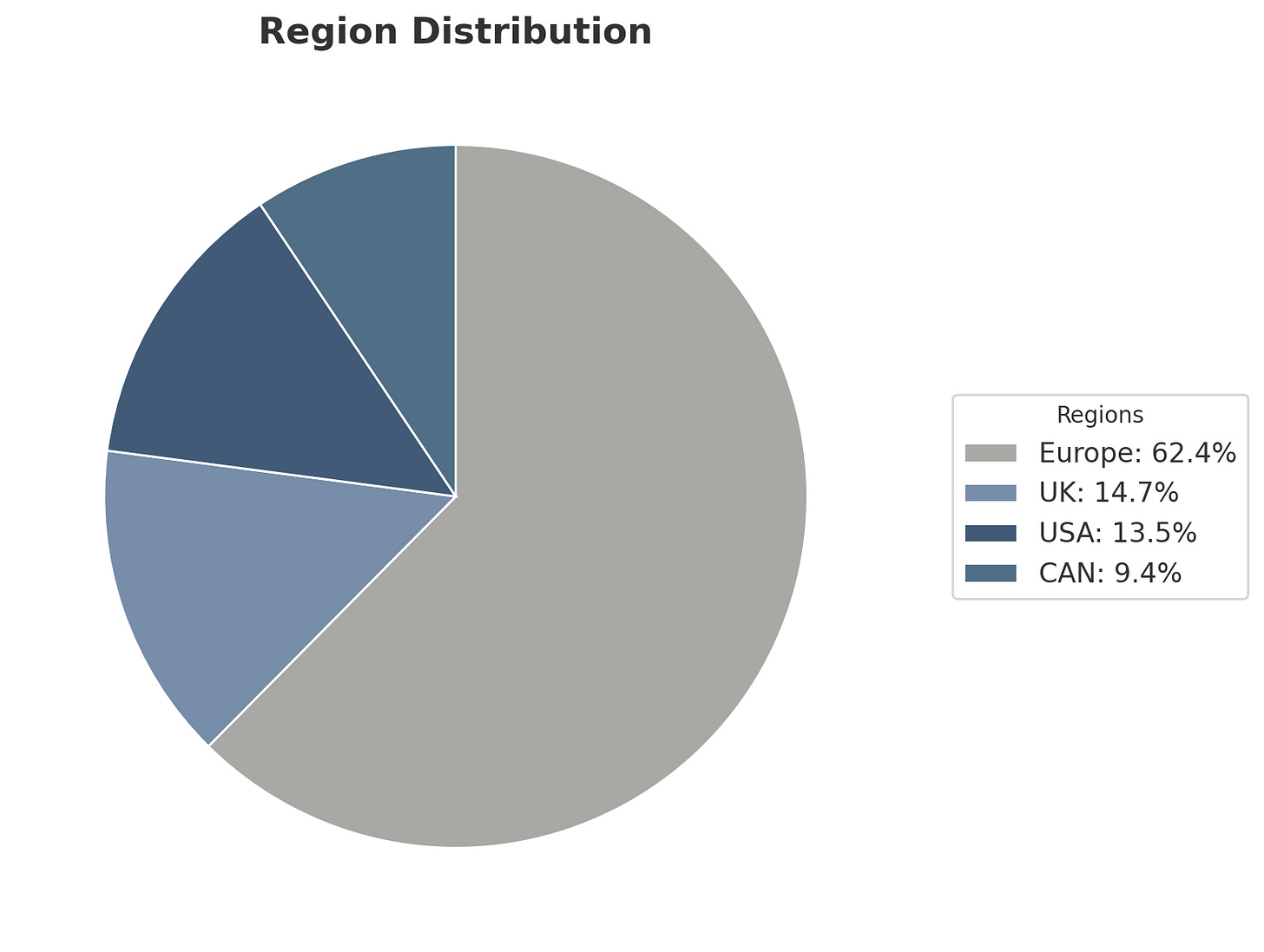

My approach benefits from broad geographic diversification, the method selects stocks from the US but also from Canada, UK, and Europe. This diversified approach provided a protective cushion when U.S. equities suffered sharp declines.

Quantitative Factors Matter

My quantitative strategy employs a systematic, data-driven ranking system focused heavily on relative valuation across multiple metrics. This method allowed the model portfolio to select only 8 U.S. stocks out of the total 50 holdings, highlighting markets and stocks offering currently superior valuations and stronger momentum outside the U.S. While the US stocks declined by 13.6% on average, the non-US stocks gained 5.5% on average.

Volatility Control Built-in

The individual stocks experienced significant volatility, with multiple stocks seeing gains of almost 50%, while one U.S. stock fell 50%. This is a behavior that can be expected from a micro-cap heavy portfolio. Yet, by being not too concentrated and by not focusing on a particular market or sector, the portfolio typically exhibits less volatility than broad indices like the S&P500. The actual sector distribution, for example, is even less Tech-heavy than the S&P500 without setting a buy limit on sector size. Depending on individual preference, The Alpha Engineer ranking does allow filtering stocks by sector and country of origin to control distribution manually.

Paid Subscription Benefits:

Weekly Stock Rankings --- Access to my proprietary ranking of approximately 3,700 stocks across the US, Europe, UK, and Canada, updated weekly

Buy/Sell Strategy --- Follow my method to build your portfolio

Model Portfolio --- Weekly transactions of the Alpha Engineer 50-stock model portfolio with performance tracking and insights in my own portfolio

Deep-Dive Analysis --- About once a month, detailed research on potential multibagger stocks that have passed my quantitative filters

Direct Access --- Get insights from someone who's spent two decades testing and refining investment strategies with skin in the game

The Alpha Engineer --- Investing with a quantitative edge

Disclaimer: The Alpha Engineer shares insights from sources I believe are reliable, but I can't guarantee their accuracy---data's only as good as its inputs! This content (whether on Substack, via email newsletters, X, or elsewhere) is for informational and educational purposes only---it's not personalized investment advice. I'm not a registered investment advisor, just an engineer crunching numbers for alpha. My opinions are my own and may shift without notice. Investing involves risks, including the chance of losing money. Past performance, whether from back-testing or historical data, does not guarantee future results---outcomes can vary. So, please consult your financial advisor to see if any strategy fits your situation. Full disclosure: I may own positions in the securities I mention, as I actively manage my own portfolio based on these strategies.