Market Overview

U.S. markets staged a remarkable recovery in May following the tumultuous volatility of early April, with major indices posting their strongest monthly gains since late 2023. This dramatic turnaround was driven by easing trade tensions, robust earnings from mega-cap technology companies, and renewed risk appetite among investors despite lingering uncertainty around fiscal policy and inflation.

The S&P 500 surged 6.3% in May, marking its best May performance since 1990 and erasing all 2025 losses to finish the month in positive territory. The tech-heavy Nasdaq Composite led the charge with a 9.6% gain, its biggest monthly advance since November 2023. The Dow Jones Industrial Average added 3.9%, its strongest monthly showing since January, though it lagged its counterparts due to weakness in healthcare and consumer defensive sectors.

The month's rally was catalyzed by a breakthrough in U.S.-China trade negotiations on May 12th, when both nations agreed to a 90-day suspension of the most onerous tariffs while pursuing a broader trade agreement. This development provided immediate relief to markets that had been rattled by the escalating tariff exchanges in April. However, volatility returned late in the month when President Trump threatened to impose 50% tariffs on the European Union starting June 1st, though markets largely shrugged off this threat as negotiating tactics.

Bond markets experienced significant turbulence as the 10-year Treasury yield briefly touched 5% mid-month amid growing concerns about the federal deficit following Moody's downgrade of U.S. sovereign debt on May 19th. The ratings agency cited "persistent, large fiscal deficits" in lowering its assessment one notch below the top tier. Despite these headwinds, technology stocks powered ahead, with Nvidia gaining over 40% for the month following strong earnings that reinforced the AI investment thesis.

European markets showed more modest gains, with the pan-European STOXX 600 recovering from early-month weakness to post a 2% gain for May. The index benefited from the U.S.-China trade détente but faced headwinds from uncertainty over potential U.S. tariffs on European goods. The euro remained relatively stable against the dollar during the month, gaining only about 0.6%.

Portfolio Performance

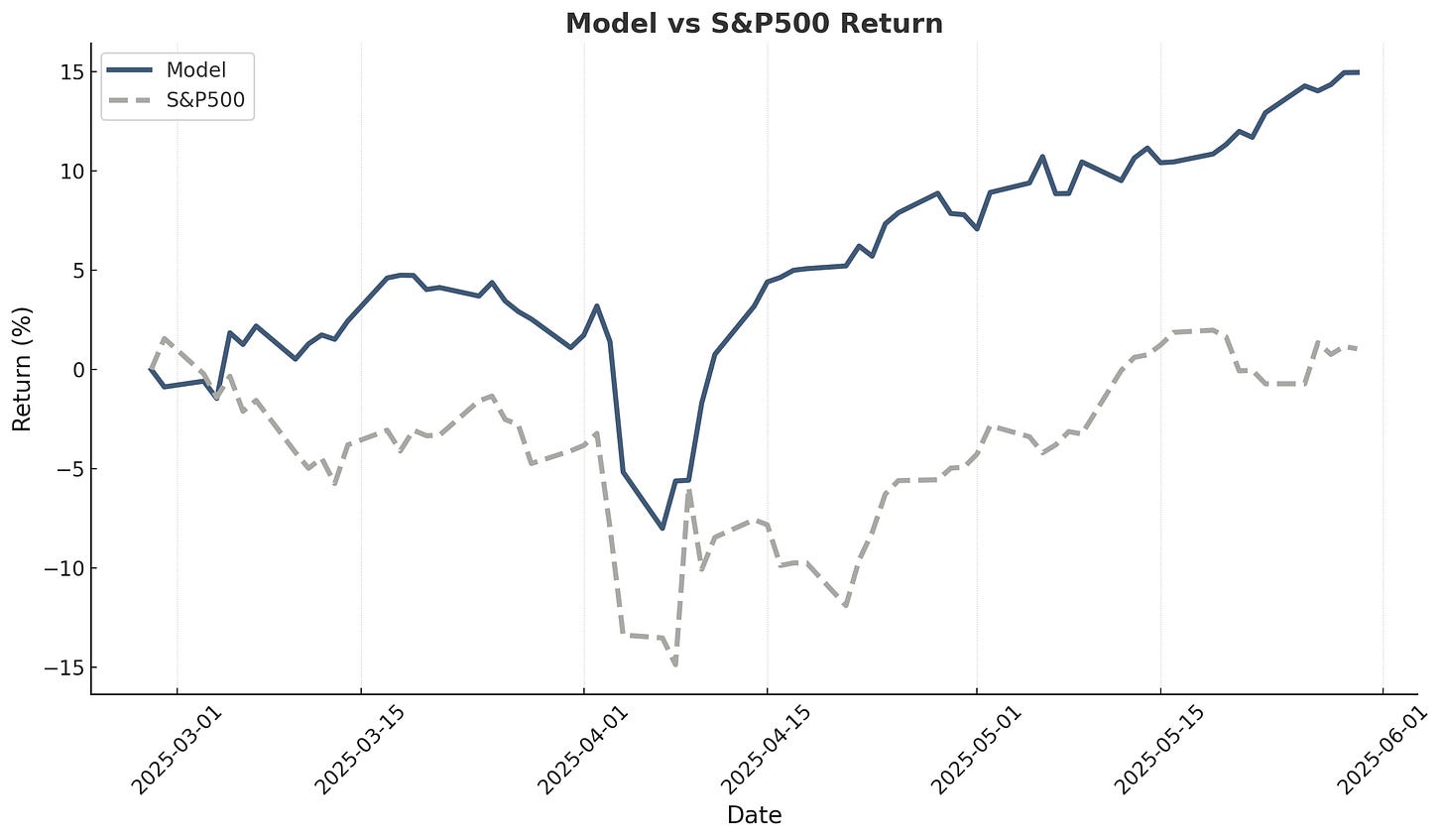

The Alpha Engineer model portfolio continued its strong performance, gaining 6.7% in May, matching its April return. This represents an alpha generation of 0.4% versus the S&P 500, notable given the portfolio's international focus—with only 4 U.S. stocks among its holdings. Since inception on February 28th, the model portfolio has delivered an impressive 15% gain compared to the S&P 500's 1% return.

During May, six positions were exited and replaced due to dropping from the ranking. Of the 9 positions closed by the end of May, 5 generated gains and 4 resulted in losses. A total of 20 positions were sold today (June 2nd) as the 60-day holding period ended, with exits determined by their current ranking position. One of these stocks became the first realized multibagger: AAC Clyde Space. I highlighted this opportunity in my March 19th note to followers. After a brief drop due to the tariffs shock, it added another 50% to its price and closed with a 125% gain.

Deep-Dive Performance

Below is the current performance overview of stocks previously featured in in-depth research analyses, including their current results and estimated targets: