Market Overview

The U.S. markets experienced significant volatility in April following the implementation of President Trump's "Liberation Day" tariffs on April 2nd. This policy decision triggered a market liquidity event, though conditions partially stabilized after Trump announced a 90-day tariff pause for most countries, excluding China. The month's trading was characterized by escalating U.S.-China tariff exchanges and weaker U.S. growth indicators, which maintained fragile risk sentiment across global markets.

The Dow Jones Industrial Average recorded its third consecutive monthly decline, dropping 3.2% for April. The S&P 500 experienced a more modest loss of 0.9%, while the tech-heavy Nasdaq Composite managed to secure a 0.9% gain, bolstered by late-month strength in mega-cap technology stocks. While cap-weighted indices limited damage in USD terms, the dollar weakened significantly, falling approximately 5% against major currencies such as the Euro and Yen.

In European markets, the pan-European STOXX 600 declined 1.2% in April, marking its second straight monthly decrease amid mixed corporate earnings reports and growing tariff concerns

Portfolio Performance

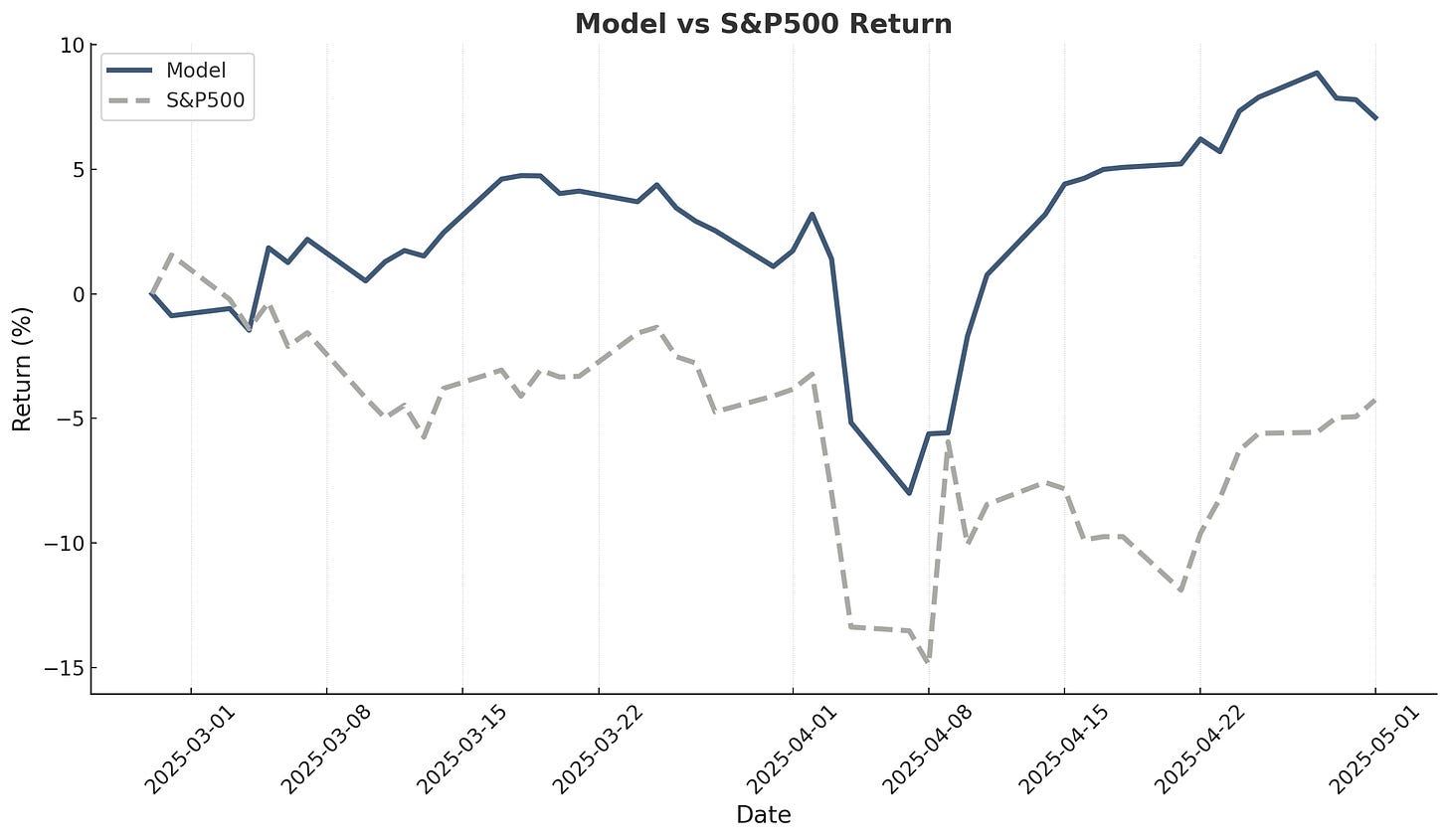

The Alpha Engineer model portfolio continued its strong performance, gaining 6.6% in April compared to the S&P 500's 0.9% decline. This represents an alpha generation of 7.5% for the month, matching the model's March outperformance. Since inception on February 28th, the model portfolio has delivered an impressive 8% gain against the S&P 500's 5% loss.

During April, three positions were exited and replaced with three new holdings. The portfolio maintains a strong 62.3% win rate across all positions.

The top three performers are all European stocks, delivering returns of 97%, 96%, and 64% respectively. Conversely, the three weakest positions include two U.S. stocks with losses of -38% and -46%, plus one Canadian stock down -60%.

The performance differential by geography is notable: of the eight U.S. stocks either currently held or previously sold, only two have generated positive returns, highlighting the challenging conditions in the U.S. market during this period.

Deep-Dive Performance

Below is the current performance overview of stocks previously featured in in-depth research analyses, including their current results and estimated targets:

Notable Developments

APM published initial results from their 2024 exploration campaign at the Golden Queen mine. The company reported significant findings including extended mineralization zones and promising drill results that could substantially enhance their resource base and operational longevity.

The Alpha Engineer --- Investing with a quantitative edge

Disclaimer: The Alpha Engineer shares insights from sources I believe are reliable, but I can't guarantee their accuracy---data's only as good as its inputs! This content (whether on Substack, via email newsletters, X, or elsewhere) is for informational and educational purposes only---it's not personalized investment advice. I'm not a registered investment advisor, just an engineer crunching numbers for alpha. My opinions are my own and may shift without notice. Investing involves risks, including the chance of losing money. Past performance, whether from back-testing or historical data, does not guarantee future results---outcomes can vary. So, please consult your financial advisor to see if any strategy fits your situation. Full disclosure: I may own positions in the securities I mention, as I actively manage my own portfolio based on these strategies.