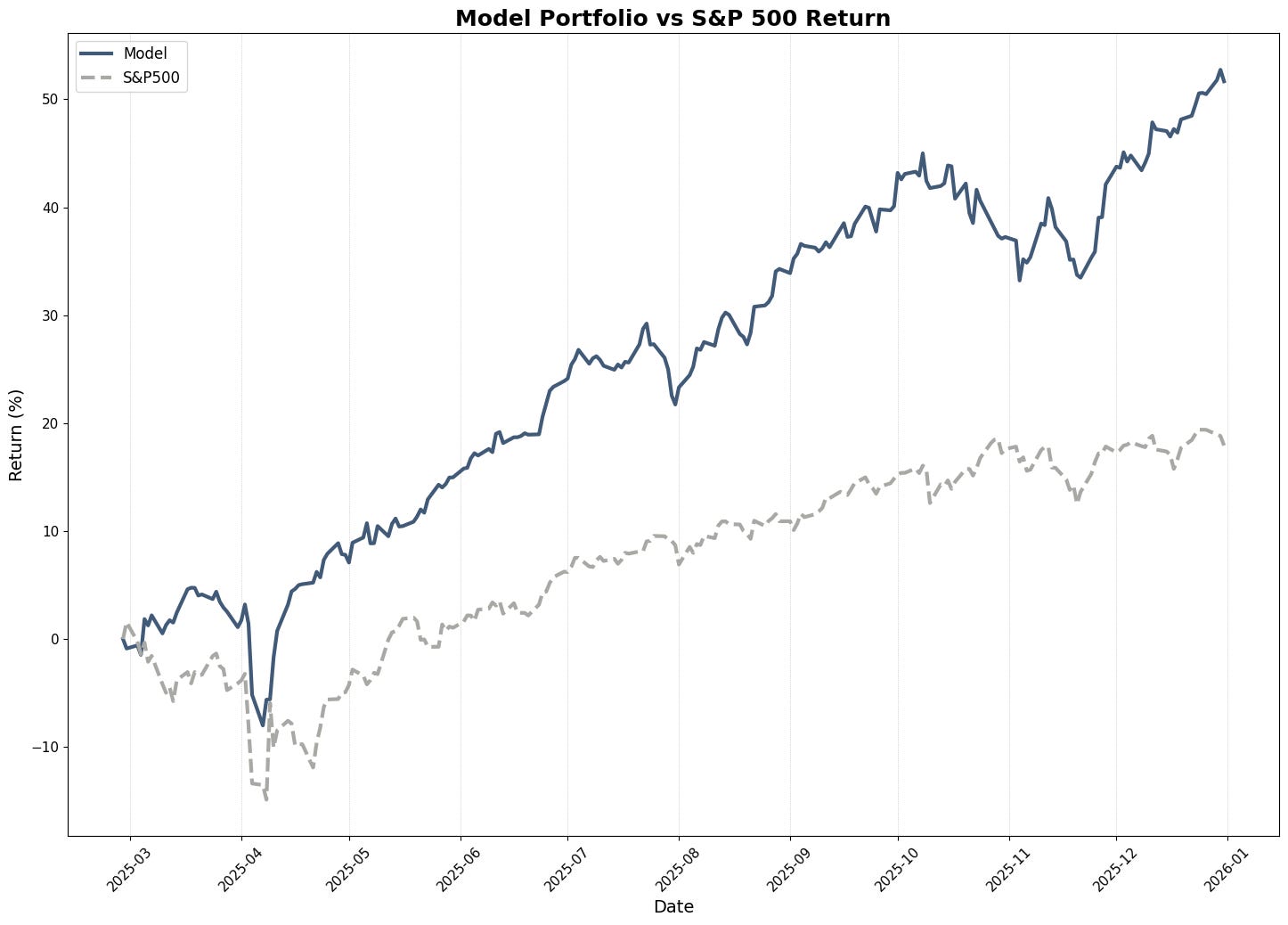

The model portfolio closed 2025 with an exceptional final month, delivering +6.7% in December while the S&P 500 was essentially flat at +0.1%. For the full year since inception on February 28th, the portfolio generated +51.7% total return versus +17.9% for the S&P 500—outperforming the benchmark by 33.8 percentage points in just ten months.

The deep-dive stocks continue to deliver remarkable results. The average return across all seven positions stands at +108%, with the original four positions added before November averaging +186%. Three of those four are multibaggers, led by APM (Andean Precious Metals) at nearly +500%.

I am very pleased with these results, both for The Alpha Engineer and personally. Following my model and deep-dive selection, my personal ‘Alpha Engineer’ portfolio achieved a return of +74.73% in 2025 (euro denominated, measured from January 1st to December 31st, as I started prior to the launch of The Alpha Engineer).

Markets in December

December 2025 capped a strong year for U.S. equities, with the S&P 500 finishing essentially flat for the month but posting a +16.4% gain for the full year—the third consecutive year of double-digit returns. The index briefly touched an all-time high above 6,930 on December 24th before giving back some gains in the final trading days.

The Federal Reserve delivered its third consecutive interest rate cut on December 10th, lowering the federal funds rate to 3.50%-3.75%. This continued easing provided meaningful support for interest-rate-sensitive sectors, particularly small caps and financials.

Small caps staged a dramatic breakout in December. The Russell 2000 hit new all-time highs, reaching 2,590 before consolidating around 2,500 by month-end. This “Great Rotation” saw investors shift capital from mega-cap technology toward domestically focused smaller companies. The Russell 2000 gained approximately 13% for the full year, with much of that performance concentrated in the final quarter.

Precious metals had an exceptional year. Gold closed 2025 at over $4,300 per ounce, up +66% for the year—its best annual performance since 1979. Silver outpaced gold dramatically, surging +144% to approximately $70 per ounce. Both metals hit fresh all-time highs in December, supported by central bank demand, geopolitical tensions, and expectations of continued monetary easing. This environment proved highly favorable for the precious metals miners in both the model portfolio and deep-dive selections.

Model Portfolio Performance

December marked the second-best monthly performance since inception, with the model generating +6.72% versus just +0.08% for the S&P 500—an excess return of +6.64% for the month. This strong finish brought the full-year results to:

Return Results (Feb 28 - Dec 31, 2025):

Total return (10 months): 51.7%

S&P 500 return (same period): 17.9%

Alpha generated: 33.8%

Annualized return: 65.8%

Monthly beats: 8 of 10 full months (80%)

Realized Trades (Feb 28 - Dec 31, 2025):

Win rate: 53% of 72 trades

Average return: 11.2%

Average days held: 113.2 days

Portfolio turnover: 136% (first 10 months or 163% annualized)

Risk-Adjusted Metrics (since inception):

Beta: 0.25

Sharpe Ratio: 3.48 (vs. 1.25 for S&P 500)

Sortino Ratio: 4.55 (vs. 1.61 for S&P 500)

Maximum Drawdown: -12.2% (vs. -16.2% for S&P 500)

The Sharpe Ratio of 3.48 is exceptional, indicating strong risk-adjusted performance well above the benchmark.

As of December 31st, the portfolio’s largest position (8.9%) remains APM (Andean Precious Metals), up over +584.8% since entry. The portfolio holds four multibaggers: three precious metals miners and a Swedish industrial stock. A fifth stock (Polish industrial) is just below the multibagger marker: 99.5%. The portfolio currently has 3 realized multibagger trades (a consumer, industrial and technology stock) and 4 others realized trades with +88% returns.

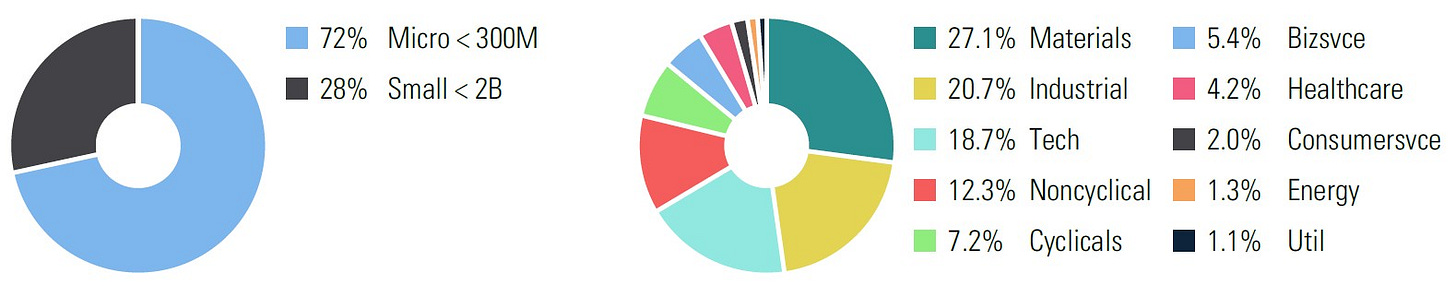

Current allocation remains concentrated in microcaps (72%) and small caps (28%), with Materials (27%) and Industrials (21%) as the largest sector exposures.

Deep-Dive Stock Performance

December brought continued strong performance from the deep-dive positions, alongside an important update on the Thunderbird Entertainment acquisition.

Deep-Dive Summary

Average return across all 7 positions: +108%

Original 4 positions (pre-November): +186% average

Multibaggers: 3 of 7 (APM, MSA, SRB)

The three multibagger deep-dives (APM, MSA, and SRB) are available to all subscribers—you can find them in the deep-dives section.

Precious Metals Miners – Outstanding Performance

The three precious metals miners continue their exceptional run, benefiting from gold and silver hitting new all-time highs in December: