The Alpha Engineer Model Delivers: 34% Return in First Six Months

The Alpha Engineer Model Portfolio

Six months ago, I launched The Alpha Engineer model portfolio with a clear mission: demonstrate that systematic, quantitative approaches can generate significant alpha in market segments that large institutions and investors overlook. The results so far validate this thesis emphatically.

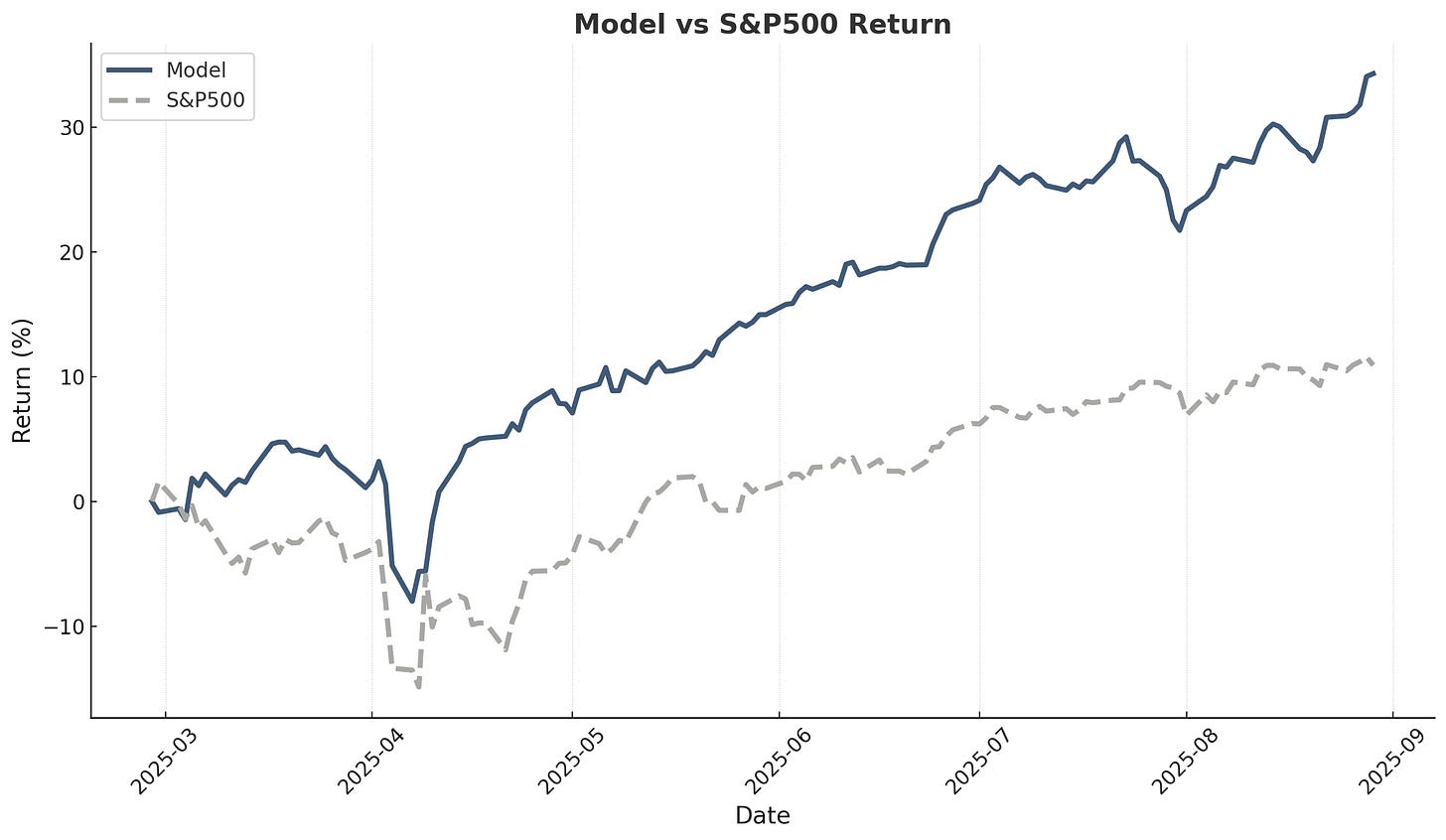

The model portfolio has delivered a 34.3% total return since inception, outperforming the S&P 500 by 23.4 percentage points. More importantly, it achieved this while maintaining superior risk metrics—proving that exceptional returns don't require excessive risk when you apply systematic methodology to inefficient market segments.

Markets in August

August proved to be a good month for equity markets, with leadership finally broadening beyond mega-caps. U.S. equities extended their run with the S&P 500 rising 2.0%, the Dow gaining 3.2%, and the Nasdaq adding 1.6%. Small caps particularly surged, with the Russell 2000 jumping approximately 7% for the month.

Policy expectations provided a key tailwind. The Fed held rates steady at 4.25%-4.50% at its July meeting, but Chair Powell's Jackson Hole speech on August 22 opened the door to a potential September cut, fueling risk-on sentiment.

European markets were only modestly up, with the STOXX Europe 600 finishing up 0.74%. The EUR/USD ended near 1.165, approximately 1.7% higher than July's close.

Model Portfolio Performance

The model portfolio delivered its strongest monthly performance in August, returning 10.3% versus 2.0% for the S&P 500—an outperformance of 8.3 percentage points in a single month. Remarkably, the portfolio has beaten the S&P 500 in five out of six months since inception, with July being the sole exception.

Key Performance Metrics:

Total Return (6 months): 34.3%

S&P 500 Return (same period): 10.9%

Alpha Generated: 23.4%

Win Rate: 57% of 44 trades

Average Winner Return: 10.2%

Portfolio Turnover: 87% (approximately 170% annualized)

The risk-adjusted performance tells an equally compelling story. The portfolio exhibited lower volatility and maximum drawdown compared to the S&P 500, demonstrating that the systematic approach effectively manages downside risk while capturing upside potential.

Check the performance report for more details:

Model Portfolio Holdings

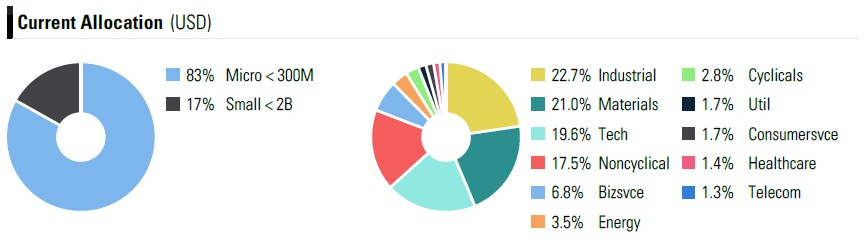

The portfolio's current largest position is gold and silver miner APM, a deep-dive stock that has surged 308% since entry. BKTI, a radio communications equipment company, represents another multibagger in the portfolio, up 130%. The systematic approach has already realized one multibagger (AAC, a satellite technology provider, sold June 2nd at +126%) and two additional positions with 90%+ returns, while currently holding five positions with gains exceeding 80%.

The three largest realized losses were contained at -64%, -40%, and -40%, while the largest current unrealized loss stands at just -26%.

Deep-Dive Stock Performance

My deep-dive stocks are an additional service for my paid subscribers. I do a much deeper quantitative and qualitative analysis for a selection of top-ranked stocks. I try to come up with a new idea every month, but it is always subject to finding good ideas that have the potential to outperform the model portfolio (which sets a high bar). All deep-dive stocks have a bear, base, and bull case target and estimated probability. They are reviewed after one year and held on the list for another year if the potential upside is still there.

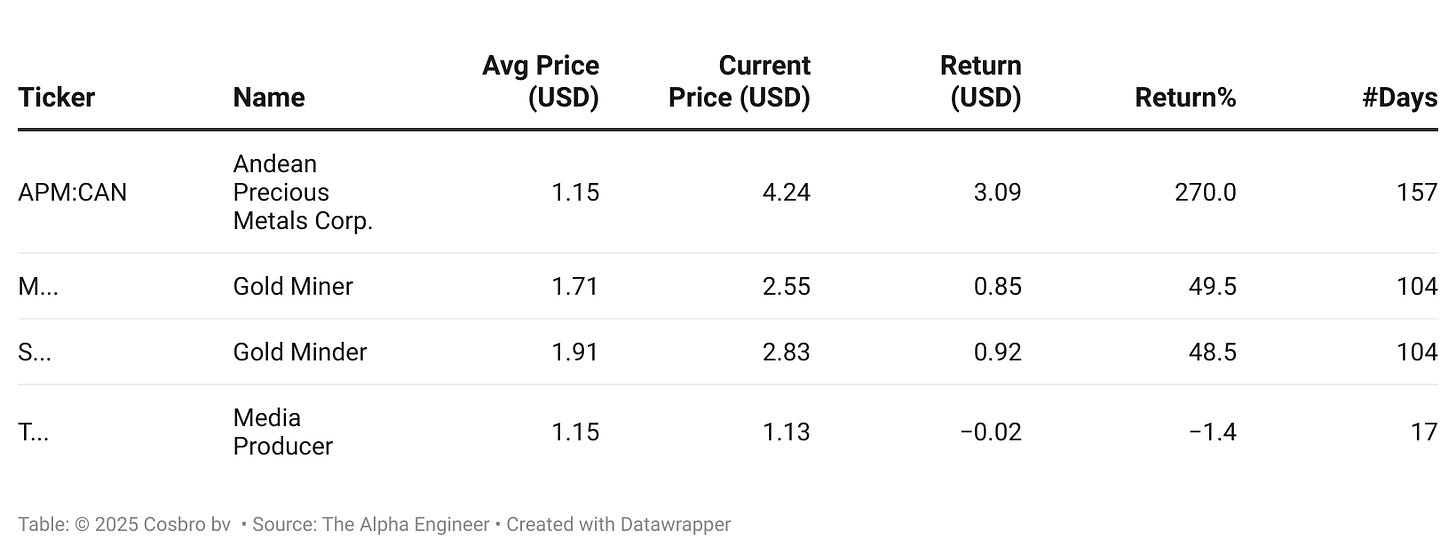

For a summary of the results, see below:

Precious metal stocks have been clear winners this year so far, as expected given macro tailwinds for silver and gold plus still-attractive valuations in micro and small-cap miners. The top of my rankings has been populated with outstanding value and momentum plays in this space. The model portfolio picked them up too, and the two biggest positions today are precious metal miners, as can be seen in the performance report.

APM was on many levels an interesting pick, being both a gold and silver miner with some operational issues but with many catalysts going for it. Two other interesting precious metal miners picks are up almost 50% in 3 months. My most recent pick comes from a completely different market that currently faces (perceived) headwinds and seems overly punished by the market. We will see how that plays out.

Personal Portfolio: Eating My Own Cooking

I manage my personal Alpha Engineer portfolio using the same systematic methodology, starting November 14, 2024—approximately 3.5 months before launching this Substack. My 20-stock mechanical portfolio shares many positions with the 50-stock model portfolio, as both draw from the top of our rankings.

I also invest in my deep-dive stocks separately. I consider them an add-on to my mechanical portfolio and over time I expect this part of the overall portfolio to grow to about half of the size of the mechanical portfolio.

Personal Portfolio Performance (9.5 months):

Overall Portfolio Return: 45% (EUR terms)

Mechanical Portfolio Return: 32% (EUR terms)

Deep-Dive Allocation Return: 175% (EUR terms)

USD Equivalent Returns: Approximately 60% overall, 47% mechanical

The outperformance of the deep-dive portion reflects the exceptional performance of precious metals miners, particularly APM where I added on the April dip and recently took partial profits.

Looking Forward: Maintaining Perspective

While these first six months exceeded expectations, especially in USD terms, maintaining perspective remains crucial. The model's long-term backtested results of about 35% spanning 15+ years remain my guide for sustainable expectations. Two important factors warrant consideration too:

Market inefficiencies captured by the model may gradually diminish

The next decade's market returns may trail the previous decade

The model portfolio will continue serving as the definitive benchmark for evaluating our systematic approach. Should long-term results diverge significantly from backtested expectations, I'll analyze whether model adjustments are warranted—always maintaining the rigor that defines The Alpha Engineer approach.

Key Takeaways

The Alpha Engineer methodology has delivered exceptional results across all three implementation strategies—the model portfolio, deep-dive picks, and my personal portfolio. The systematic approach successfully identified and captured alpha in inefficient market segments, particularly in overlooked small-cap value plays with strong momentum characteristics.

Most importantly, these results validate the core thesis: individual investors can generate significant alpha by applying quantitative discipline to market segments where large institutions cannot effectively compete. The combination of systematic stock selection, emotion-free execution, and focus on inefficient market segments continues proving its worth.

The Alpha Engineer --- Investing with a quantitative edge

Disclaimer: The Alpha Engineer shares insights from sources I believe are reliable, but I can't guarantee their accuracy---data's only as good as its inputs! This content (whether on Substack, via email newsletters, X, or elsewhere) is for informational and educational purposes only---it's not personalized investment advice. I'm not a registered investment advisor, just an engineer crunching numbers for alpha. My opinions are my own and may shift without notice. Investing involves risks, including the chance of losing money. Past performance, whether from back-testing or historical data, does not guarantee future results---outcomes can vary. So, please consult your financial advisor to see if any strategy fits your situation. Full disclosure: I may own positions in the securities I mention, as I actively manage my own portfolio based on these strategies.