Market Overview

U.S. markets continued their momentum in June despite a mid-month shock from the Israel-Iran conflict, with major indices posting solid gains for the second consecutive month and the S&P 500 achieving new record highs. The month's performance demonstrated remarkable resilience as investors navigated geopolitical tensions, ongoing trade negotiations, and a Federal Reserve steadfast in its patient approach to monetary policy.

The S&P 500 gained 5.1% in June, breaking through the 6,000 level early in the month and ultimately closing at a record high on June 27th—its first all-time peak since February. The tech-heavy Nasdaq Composite outperformed with a 6.6% advance, also hitting record territory late in the month as AI-related stocks continued to attract strong investor interest. The Dow Jones Industrial Average lagged with a more modest 4.3% gain, held back by continued weakness in healthcare and consumer defensive sectors.

The month's trajectory was dramatically disrupted on June 13th when Israel launched surprise airstrikes on Iranian nuclear facilities, triggering a four-day exchange of fire between the two regional powers. The escalation sent the S&P 500 tumbling 1.1% that Friday, with oil prices surging over 7% and defense stocks rallying sharply. However, markets quickly recovered the following week as a fragile ceasefire was reached on June 23rd, with investors viewing the conflict as likely to remain contained rather than escalating into a broader regional war.

The Federal Reserve maintained its wait-and-see stance at the June 17-18 meeting, holding rates steady at 4.25%-4.50% for the fourth consecutive meeting. Fed Chair Jerome Powell reiterated that policymakers could afford to be "patient" given continued economic strength, though the updated dot plot suggested officials still anticipated two rate cuts before year-end. Treasury yields retracted a bit but remained elevated throughout the month, with the 10-year yield hovering around 4.35% as investors weighed persistent deficit concerns against recession risks.

European markets faced a challenging month, with the pan-European STOXX 600 returning -1.3% in June, weighed down by ongoing uncertainty about U.S. tariffs on European goods, mixed economic data from the region, and concerns about the Israel-Iran conflict's impact on global trade. The euro strengthened notably against the dollar during the month, climbing 3.4% to reach 1.172 by month-end—its highest level since early 2025—as dollar weakness persisted amid concerns about U.S. fiscal sustainability and trade policies. So in dollar terms, the STOXX 600 did gain about 2%.

Portfolio Performance

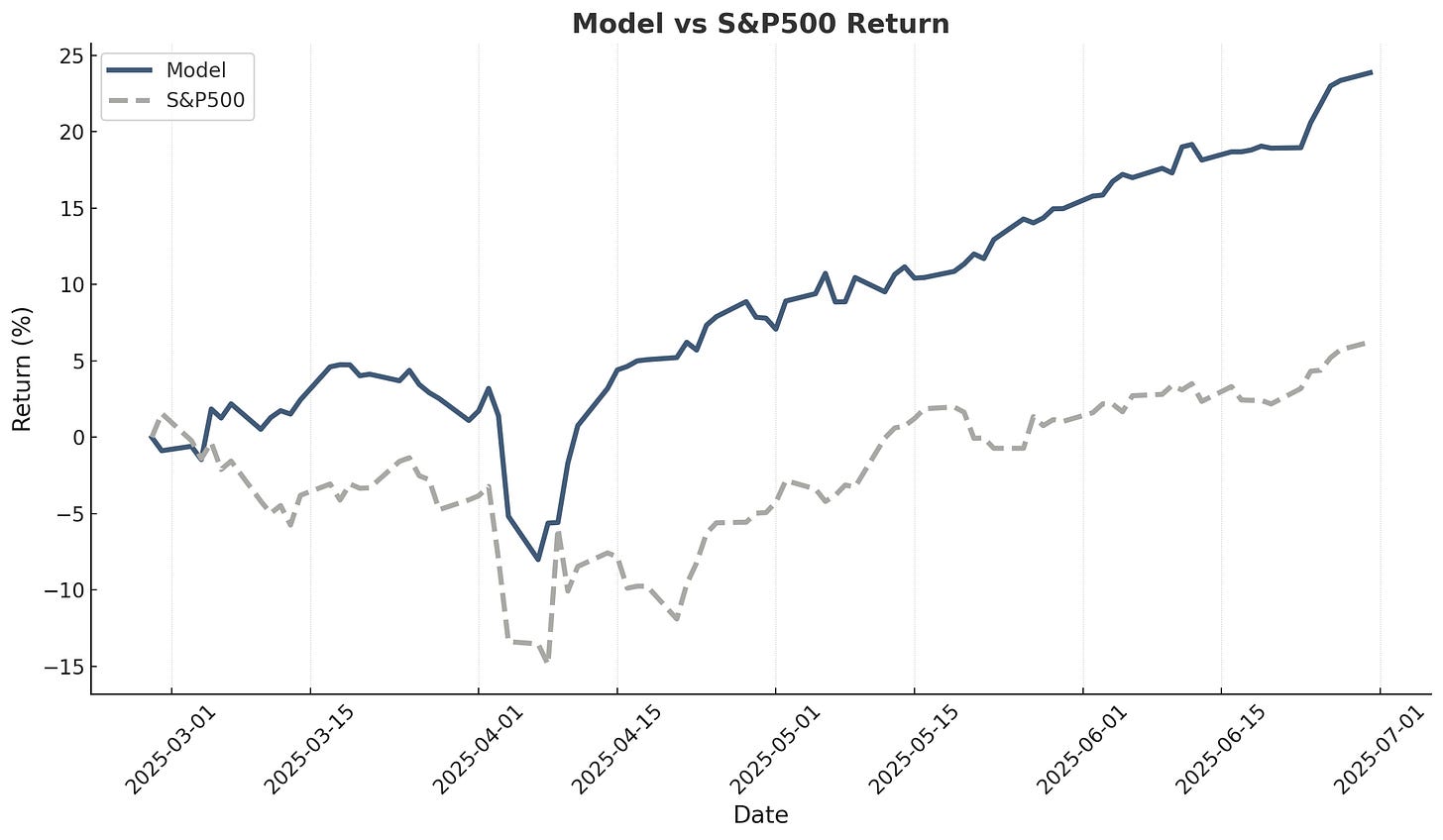

The Alpha Engineer model portfolio continued its strong performance, gaining 7.7% in June, its best monthly performance yet, despite being heavily concentrated in European stocks (80%). This represents an alpha generation of 2.6% versus the S&P 500. Since inception on February 28th, the model portfolio has delivered an impressive 23.9% gain compared to the S&P 500's 6.2% return.

As mentioned in the May performance article, 23 positions were exited at the start of the month and replaced as the three month holding period ended and ranking-based selling started. Currently, the portfolio has 69.5% winners (realized and unrealized combined).

Deep-Dive Performance

Below is the current performance overview of stocks previously featured in in-depth research analyses, including their current results and estimated targets. The three stocks returned 74%, 4% and 17% respectively since their deep-dive report: